Forecast update for Gold -17-09-2025

AI Summary

- Gold price declined in last intraday trading but may be close to recovery, with positive signals indicating potential bullish momentum.

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices.

- Subscription packages for specialized trading signals range from €44/month for US Stock Signals to €179/month for VIP Signals.

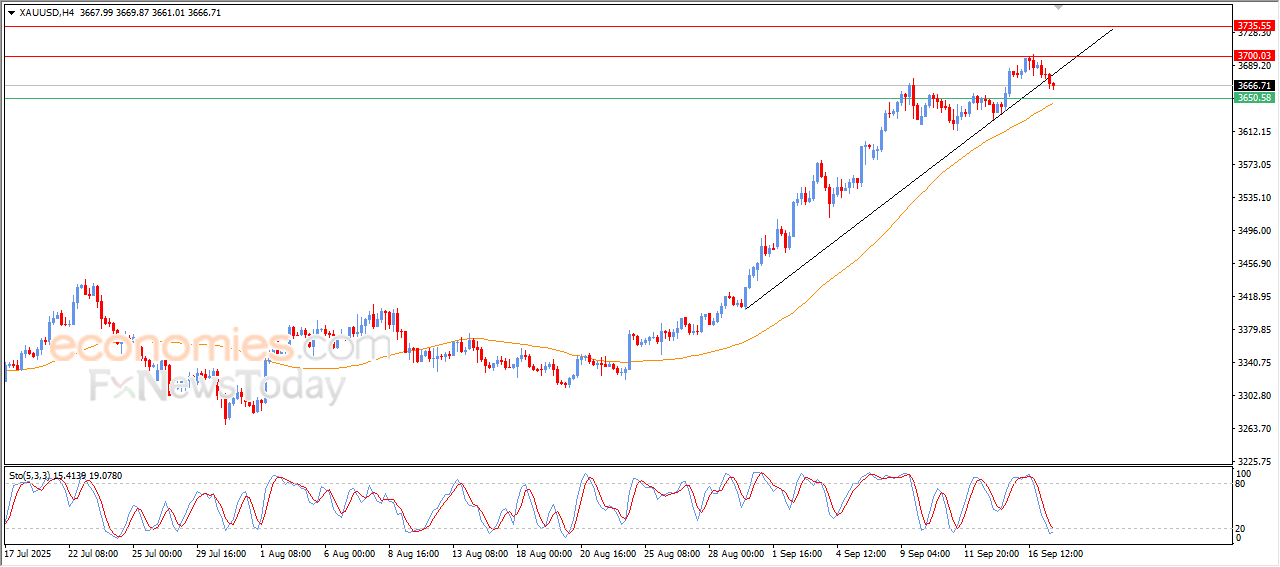

The price of (Gold) declined in its last intraday trading, in attempt to look for rising low to take it as a base that might help it to gain the required bullish momentum to recover, to break a minor bullish trend line on the intraday levels, which put it under temporary pressure, which extended its correctional losses.

On the other hand, the relative strength indicators reached exaggerated oversold levels compared by the price movement, suggesting the beginning of forming positive divergence, which represents positive signals that indicate that the price is close from its recovery, especially with its approach from the support of EMA50, to reinforce the chances of its recovery.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

Forecast update for EURUSD -17-09-2025.

The price of (EURUSD) declined from its four-years high, to gather the gains of its previous rises, which might help it to recover and rise again, and it is attempting to offload its overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from there, amid the dominance of the main bullish trend and its trading alongside supportive main and minor trendlines.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

Natural gas price losses the negative momentum– Forecast today – 17-9-2025

Natural gas price lost the negative momentum by stochastic rally to 80 level, which forces it to delay the negative attack and form some bullish correctional waves, to settle near $3.120.

Reminding you that the main bearish scenario will remain valid depending on the stability of the resistance at $3.240, which makes us wait for gathering the extra negative momentum, to renew the negative attempts that target $2.940 and $2.820 levels initially.

The expected trading range for today is between $2.940 and $3.200

Trend forecast: Bearish

The CADJPY prefers the psotivity– Forecast today – 17-9-2025

Despite the weakness of the CADJPY last trading, its fluctuation above the extra support at 105.90 forms a main factor to motivate the bullish track again, the price success by gathering the positive momentum will ease the mission of attacking the resistance at 107.60, and surpassing it will open the way for recording new gains that might extend to 108.10 and 108.75.

While the price decline below the current support and providing daily close below it will confirm its move to the negative track, which forces it to suffer several losses by reaching 105.55 and 105.05.

The expected trading range for today is between 106.00 and 107.60

Trend forecast: Bullish