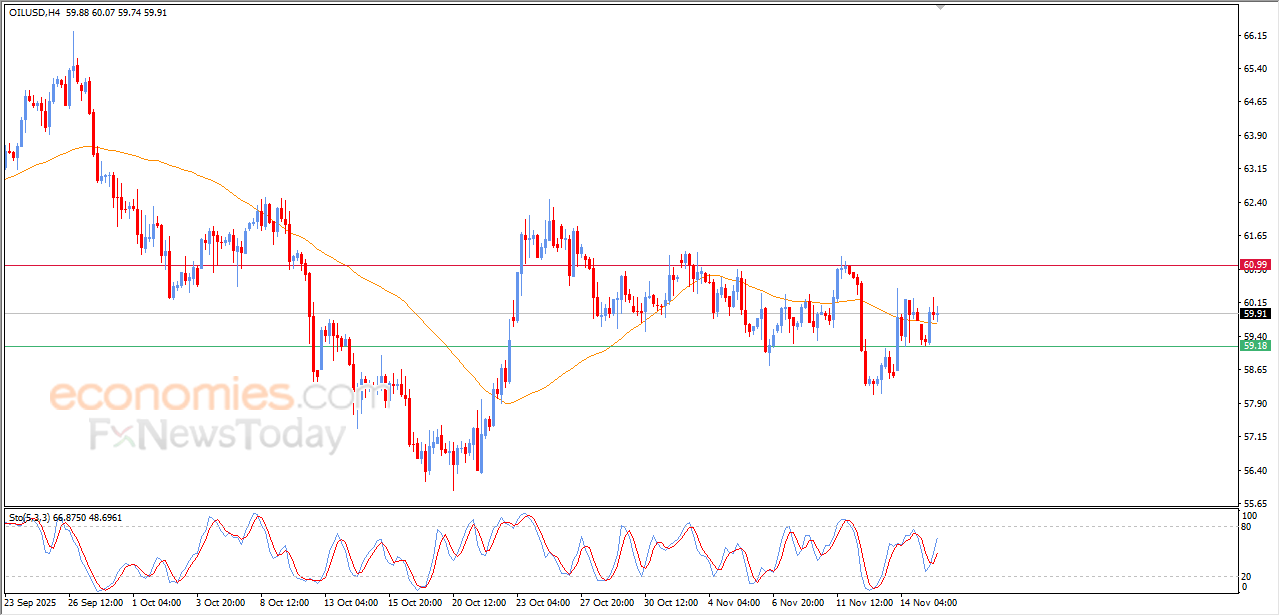

Evening update for crude oil -17-11-2025

The (crude oil) rose slightly in its last intraday trading, taking advantage of its trading above EMA50, with the emergence of the positive signals on the relative strength indicators, reinforcing the bullish momentum, and might push it to surpass its current limits and targeting new resistance levels.

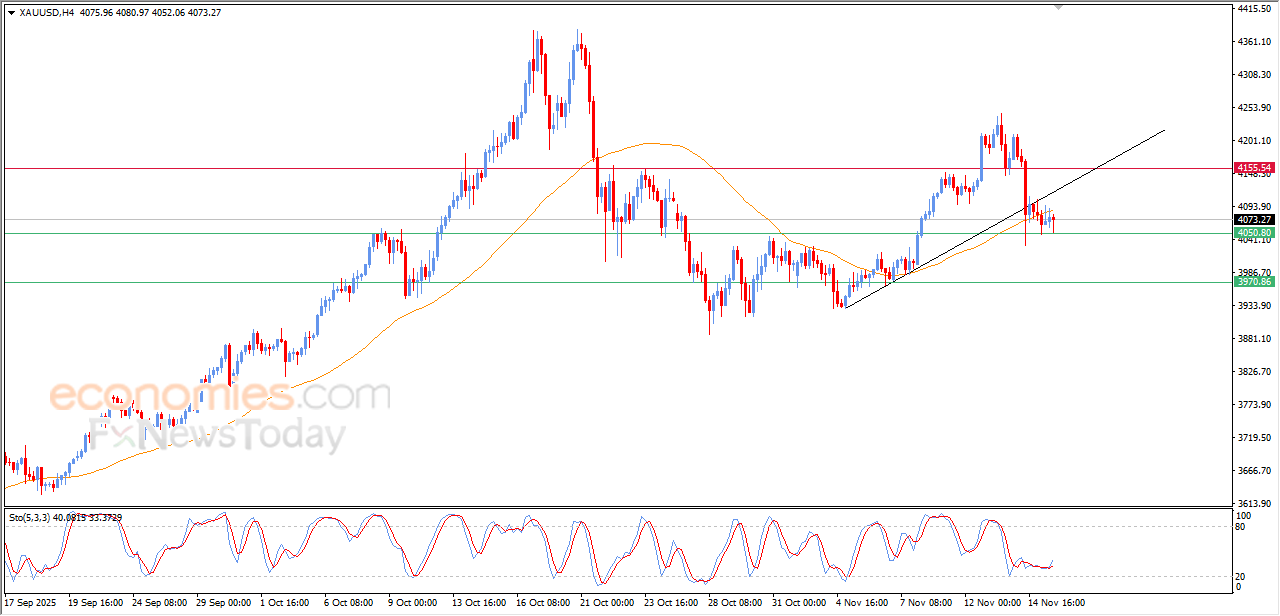

Evening update for Gold -17-11-2025

The (Gold) price continued its fluctuating trading on an intraday basis, affected by the emergence of positive signals on the relative strength indicators, after reaching oversold levels, with negative pressure due to its trading below EMA50, affected by breaking minor bullish trend line on a short-term basis.

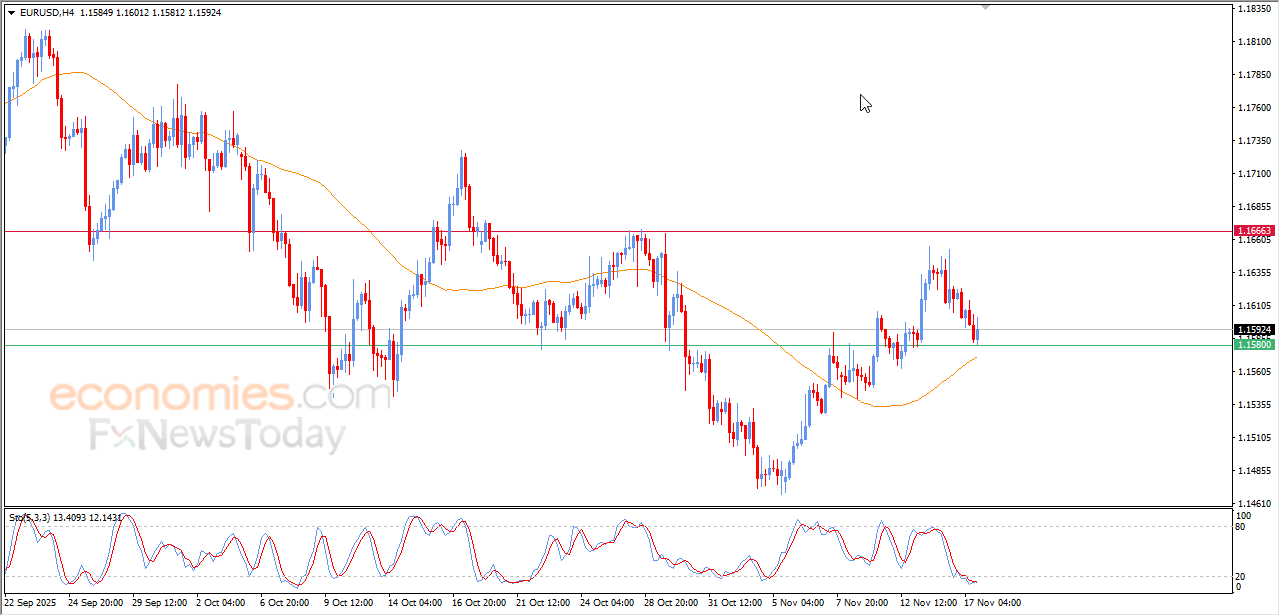

Evening update for EURUSD -17-11-2025

The (EURUSD) rose in its last intraday trading, after retesting the key support at 1.1580, the stability of this support provided bullish momentum that helped it to achieve these gains, amid the dominance of bullish corrective wave on the short- term basis, with the emergence of positive overlapping signals on the relative strength indicators, after reaching oversold levels.

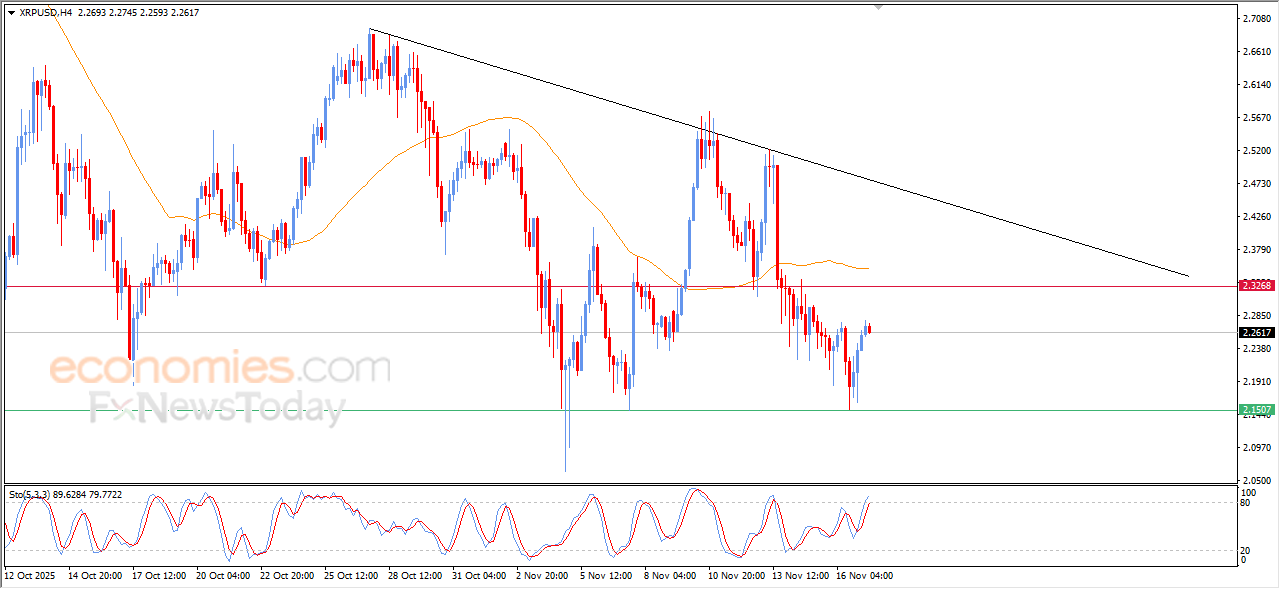

Ripple price shows clear signs of weakness - Analysis - 17-11-2025

Ripple (XRPUSD) held onto slight gains in its latest intraday trading, managing to recover part of its previous losses. However, the price continues to face dynamic negative pressure as it remains below the 50-day simple moving average, while the broader short-term trend stays bearish. In addition, RSI indicators have reached extremely overbought levels—far beyond what is justified by price action—suggesting a potential negative divergence, which may intensify the surrounding downside pressure.

Therefore, we expect the coin to decline in the upcoming intraday sessions, as long as it remains below the resistance level of $2.3268, targeting the key support at $2.1510.

Today’s price forecast: Bearish