Copper price begins to gather gains– Forecast today – 2-2-2026

Copper price confirmed its surrender to the bearish corrective bias by its repeated stability below the resistance near $6.000, to begin gathering some gains by reaching $5.6700, to record some suggested targets in the previous report.

The continuation of providing negative momentum by stochastic will increase the chances of targeting $5.5100 support, which represents the confirmation key for the expected trend in the near and medium period.

The expected trading range for today is between $5.5100 and $5.9000

Trend forecast: Bearish

The (ETHUSD) is deepening its losses- Analysis- 02-02-2026

The (ETHUSD) price is experiencing free fall in its last intraday trading, amid the main bearish trend on short-term basis, with the continuation of the negative pressure due to its trading below EMA50, intensifying the negative pressures around the price, especially with the emergence of negative signals from relative strength indicators, despite reaching oversold levels, indicating the strength and volume of the bearish momentum in the near period.

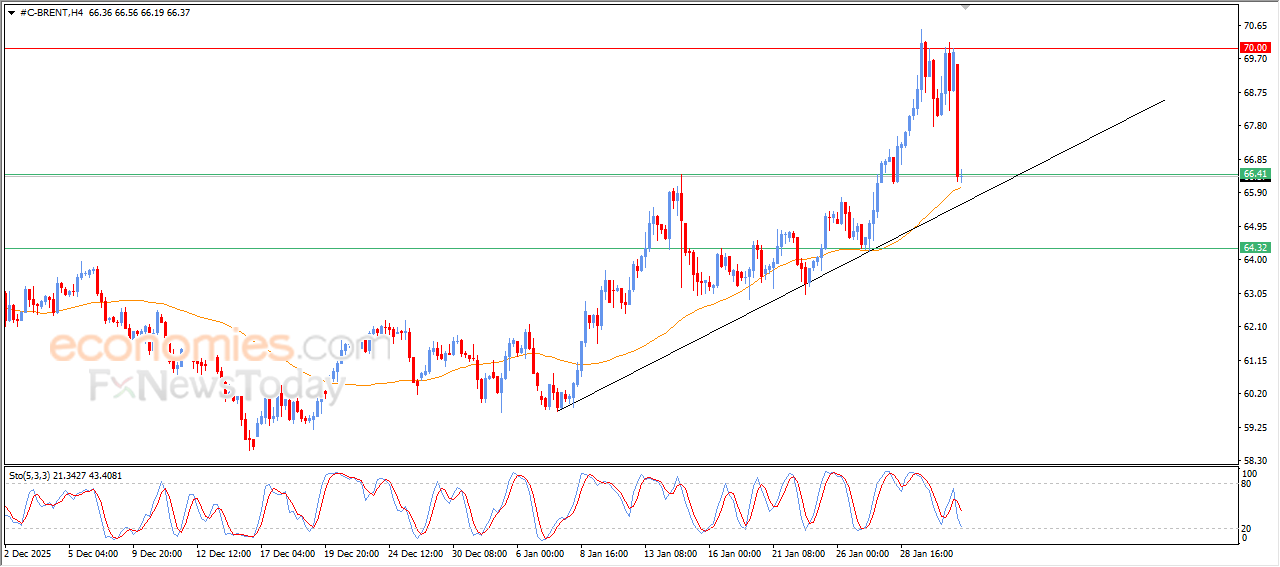

Brent crude oil price is leaning on the support of its simple moving average- Analysis- 02-02-2026

The (Brent) price slipped lower in its last intraday trading, amid the emergence of negative signals from relative strength indicators, after offloading its oversold conditions previously, opening the way for recording those losses, to lean on EMA50’s support, which might provide a chance for gaining bullish momentum to help it rebound higher, especially with its trading alongside minor bullish trend line on short-term basis that reinforces this scenario.

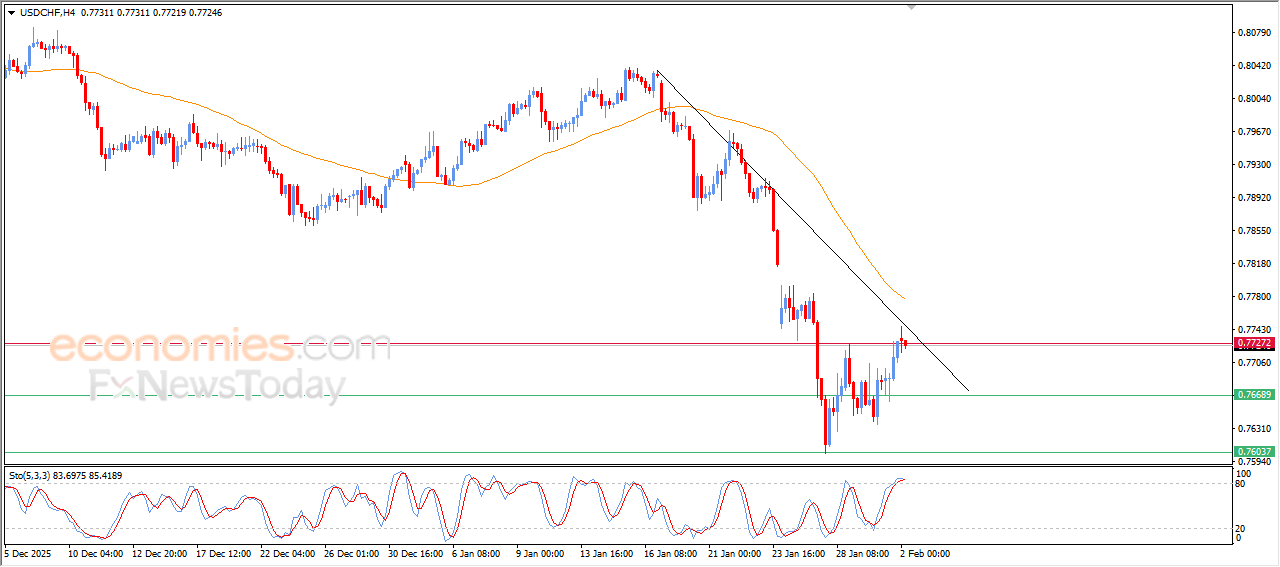

The USDCHF Price is showing new negative signals- Analysis-02-02-2026

The (USDCHF) price settles on gains in its last intraday trading, to test 0.7725 key resistance, accompanied by testing minor bearish trend line on short-term basis, amid the continuation of the negative pressure due to its trading below EMA50, which reduces the chances of full recovery on near-term basis, with the emergence of negative overlapping signals from relative strength indicators, after reaching overbought levels.