Copper price needs extra momentum– Forecast today – 18-12-2025

Copper price neediness to the bullish momentum led to end the last bullish rally by hitting $5.4300 level, which forces it to form sideways trading to settle near $5.3000, keeping our bullish expectations depending on the stability of extra support at $5.1300, to confirm gathering extra bullish momentum to press on the barrier at $5.5000, surpassing it will open the way for recording extra gains by its rally towards $5.6300 and $5.7400.

While the decline below the extra support and providing negative close will confirm its surrender to the bearish corrective bias, to expect suffering several losses by reaching $4.9200 initially.

The expected trading range for today is between $5.2000 and $5.5000

Trend forecast: Bullish

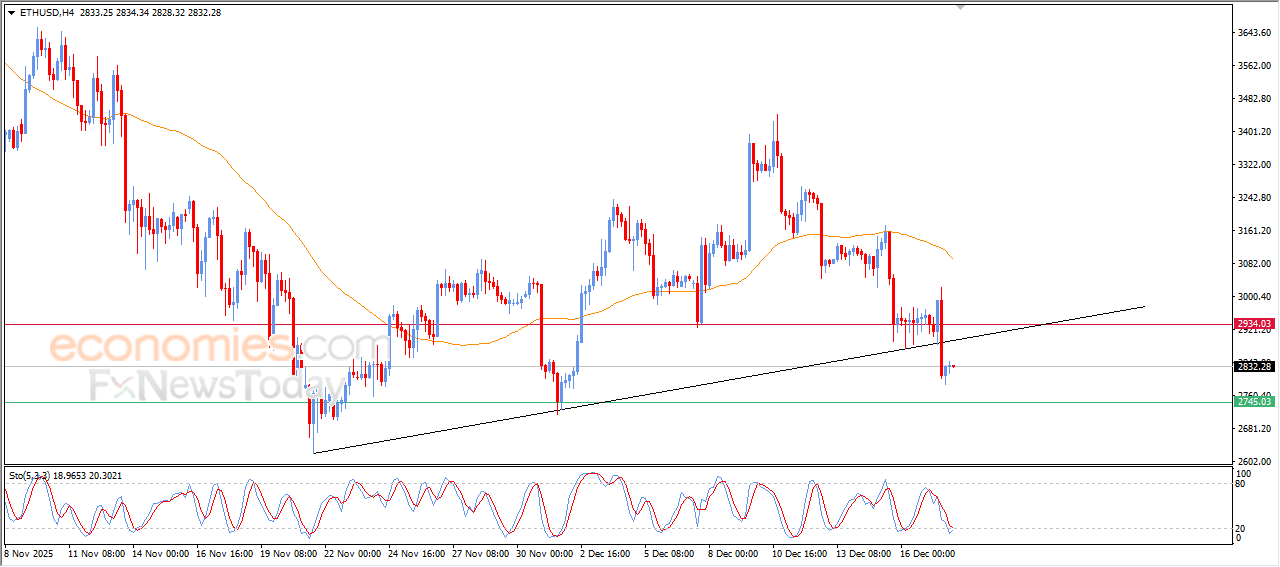

The (ETHUSD) is breaking bullish corrective trend line- Analysis- 18-12-2025

The (ETHUSD) price settled on sharp losses during its last intraday trading, breaking bullish corrective trend line on the short-term basis, amid the continuation of the negative pressure due to its trading below EMA50, intensifying the negative pressure on the price, with the emergence of negative signals on the relative strength indicators, despite reaching oversold levels.

Brent crude oil is under negative pressure- Analysis- 18-12-2025

The (Brent) price declined on its last intraday trading, with the beginning of forming negative divergence on the relative strength indicators, after reaching exaggerated overbought levels compared to the price move, with the emergence of negative signals, testing steep minor bearish trend line on the short-term basis, indicating its dominance which intensifies with its trading below EMA50.

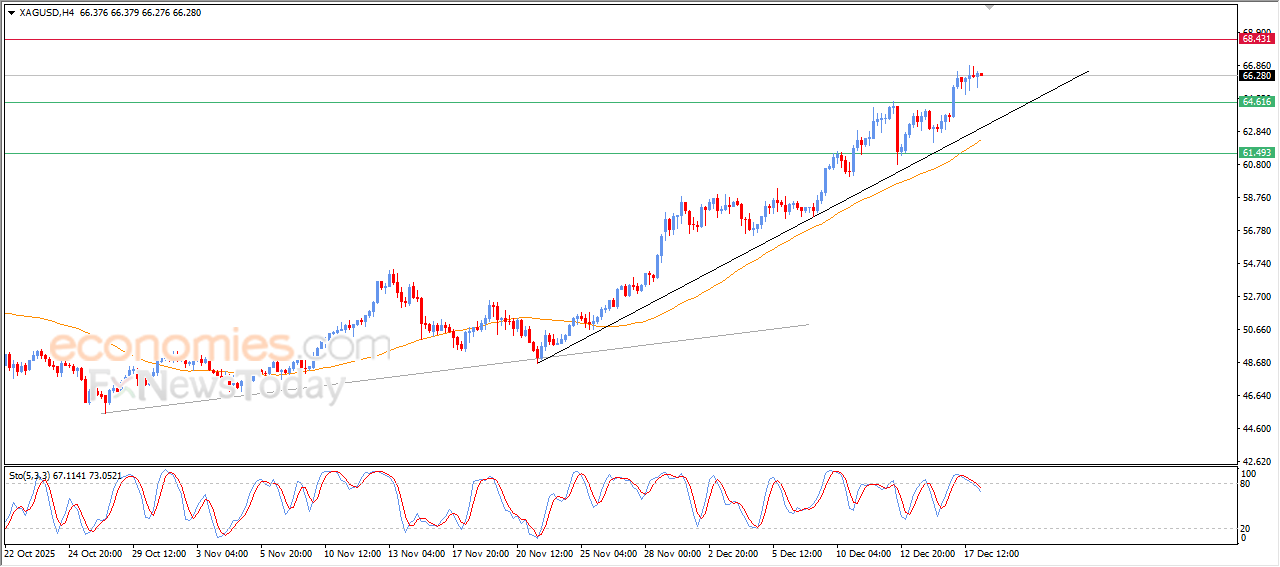

Silver price is attempting to offload its overbought conditions - Analysis-18-12-2025

Silver price witnessed fluctuated trading in its last intraday levels, attempting to gain bullish momentum that might help it to resume its strong gains, and offloading its overbought conditions on the relative strength indicators, especially with the emergence of negative signals from relative strength indicators, amid the continuation of the dynamic support that is represented by its trading above EMA50, which reinforces the stability and dominance of the main bullish trend on the short-term basis, especially with its trading alongside trend line.