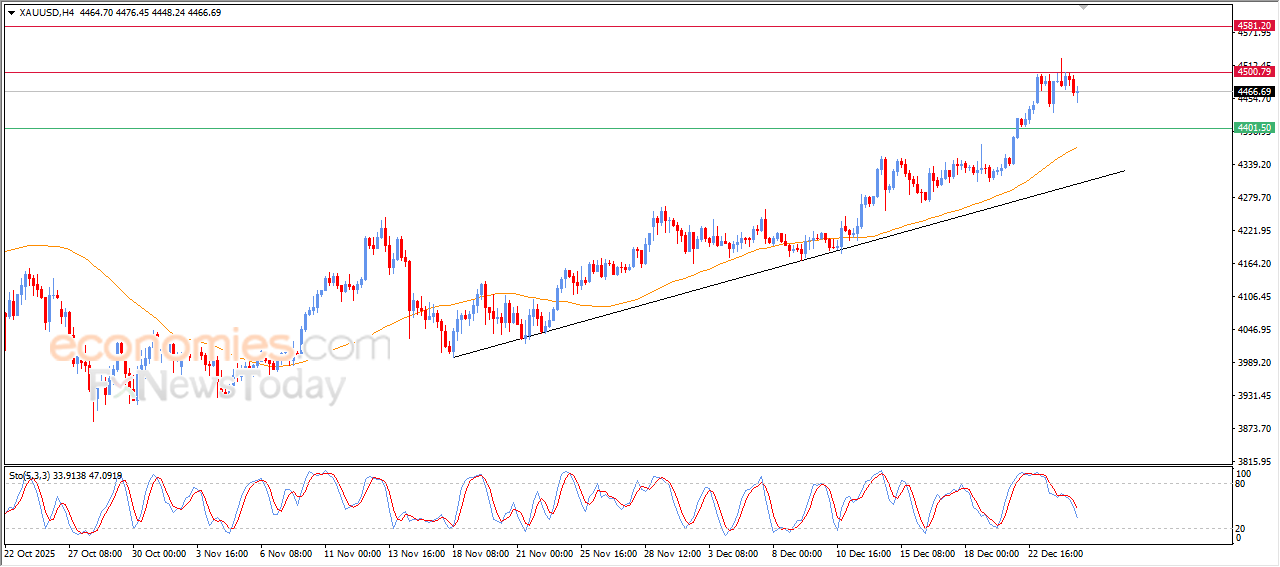

Evening update for Gold -24-12-2025

(Gold) witnessed fluctuating trading on the last intraday levels, amid attempts to gain bullish momentum that might help it to breach the main resistance level at $4,500, with the continuation of the positive support of EMA50, under the dominance of the main bullish trend on the short-term basis, on the other hand, noticing the emergence of negative signals on the relative strength indicators.

Evening update for EURUSD -24-12-2025

The (EURUSD) declined on its last trading in the intraday basis, due to the stability of the of the key resistance at 1.1800, with the emergence of the negative signals on the relative strength indicators after forming negative divergence, attempting to gain bullish momentum that may help it to recover and rise again, amid the continuation of the dynamic support of EMA50, under the dominance of the main bullish trend on the short-term basis.

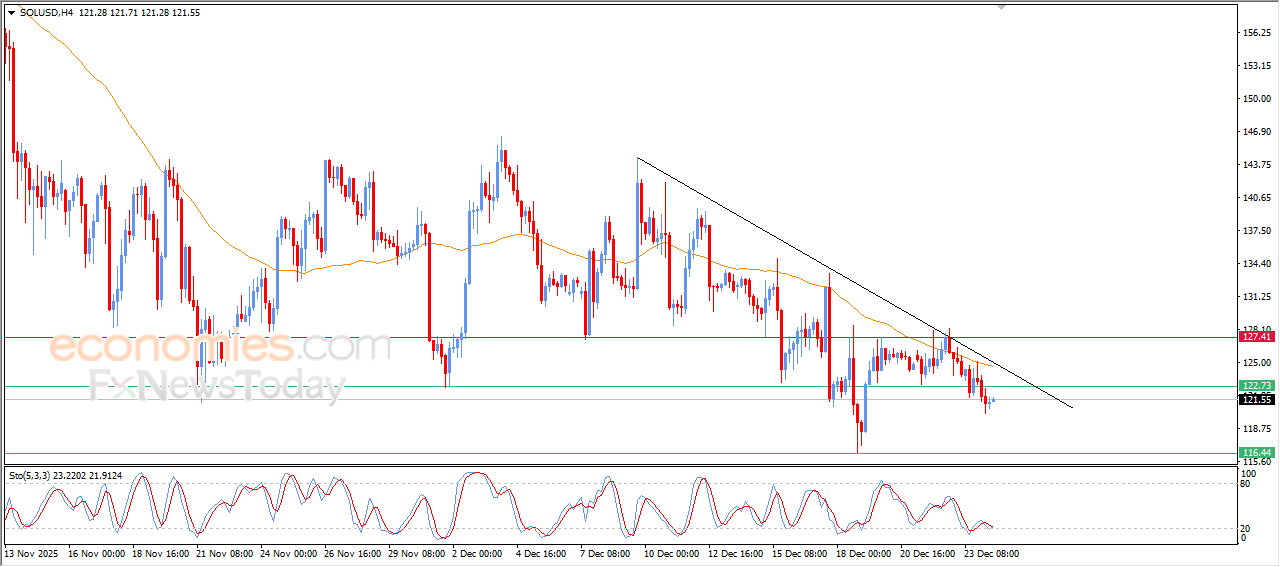

Solana coin suffers from negative pressures - Analysis - 24-12-2025

Solana (SOLUSD) remains under pressure in its latest intraday trading, as negative pressure persists from trading below the 50-period SMA, reinforcing the stability and dominance of the main bearish trend. Price action continues to move alongside a minor downward trendline on the short term, while negative signals are coming from the RSI after the indicator managed to unwind its oversold conditions.

Therefore we expect the cryptocurrency price to decline further in the upcoming intraday trading, especially as long as the price remains below 122.75, to target the key support level at 116.50.

Today’s price forecast: Bearish

Stellar Coin faces negative outlook - Analysis - 24-12-2025

Stellar (XLMUSD) remained under pressure in its latest intraday trading, as losses persisted while the price stays below the key resistance at 0.2165. The main bearish trend continues to dominate the short term, with price action moving alongside a minor downward trendline that supports this path. Additional negative pressure comes from trading below the 50-period SMA, while bearish signals from the RSI further intensify the downside bias.

Therefore we expect the cryptocurrency price to decline further in the upcoming intraday trading, as long as resistance at 0.2165 holds, to target the key support level at 0.2040.

Today’s price forecast: Bearish