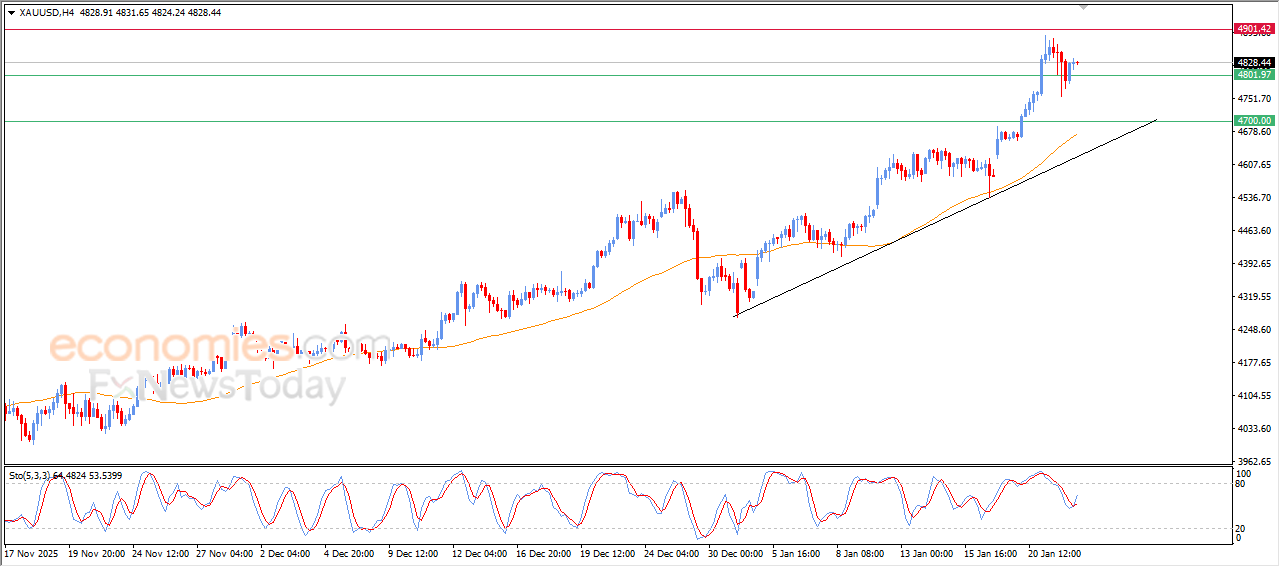

Forecast update for gold -22-01-2026.

The price of gold rose in its last intraday trading, to settle above the main resistance at $4,800, taking advantage of the dynamic support that is represented by its trading above EMA50, reinforcing the stability and dominance of the main bullish trend on short-term basis, especially with its trading alongside minor trend line, noticing the negative signals from the relative strength indicators, after offloading its overbought conditions on relative strength indicators, after offloading its overbought conditions, opening the way for achieving more gains on near-term basis.

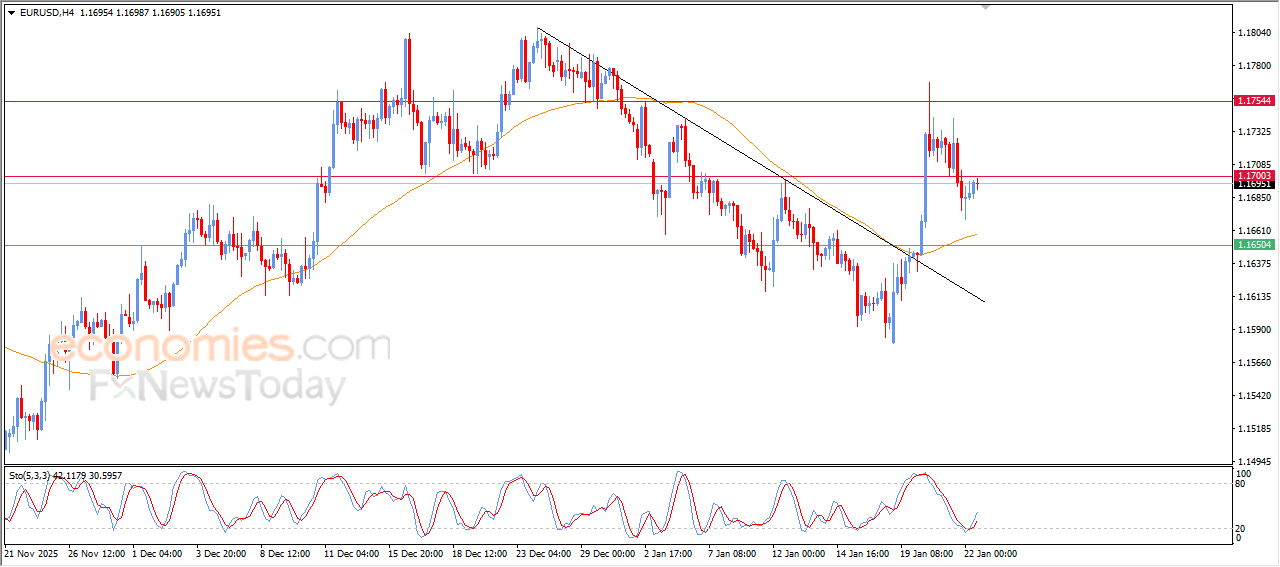

Forecast update for EURUSD -22-01-2026.

The price of EURUSD rose in its last intraday trading, supported by its continuous trading above EMA50, providing support base that provided bullish momentum, especially with the emergence of positive divergence on relative strength indicators, after reaching oversold levels, exaggerated compared to the price move with the emergence of positive signals from there, reinforcing the chances of extending its intraday gains.

EURNZD continues the decline– Forecast today – 22-1-2026

The EURNZD is experiencing new negative pressure, which forces it to reach below the moving average 55 at 2.0070, to confirm the surrender of the bearish scenario to settle near 1.9955.

The stability of stochastic within the oversold levels will increase negative pressures on today’s trading, which makes us prefer more negative attempts, which might target 1.9875 level reaching extra support at 1.9770.

The expected trading range for today is between 2.0025 and 1.9875

Trend forecast: Bearish

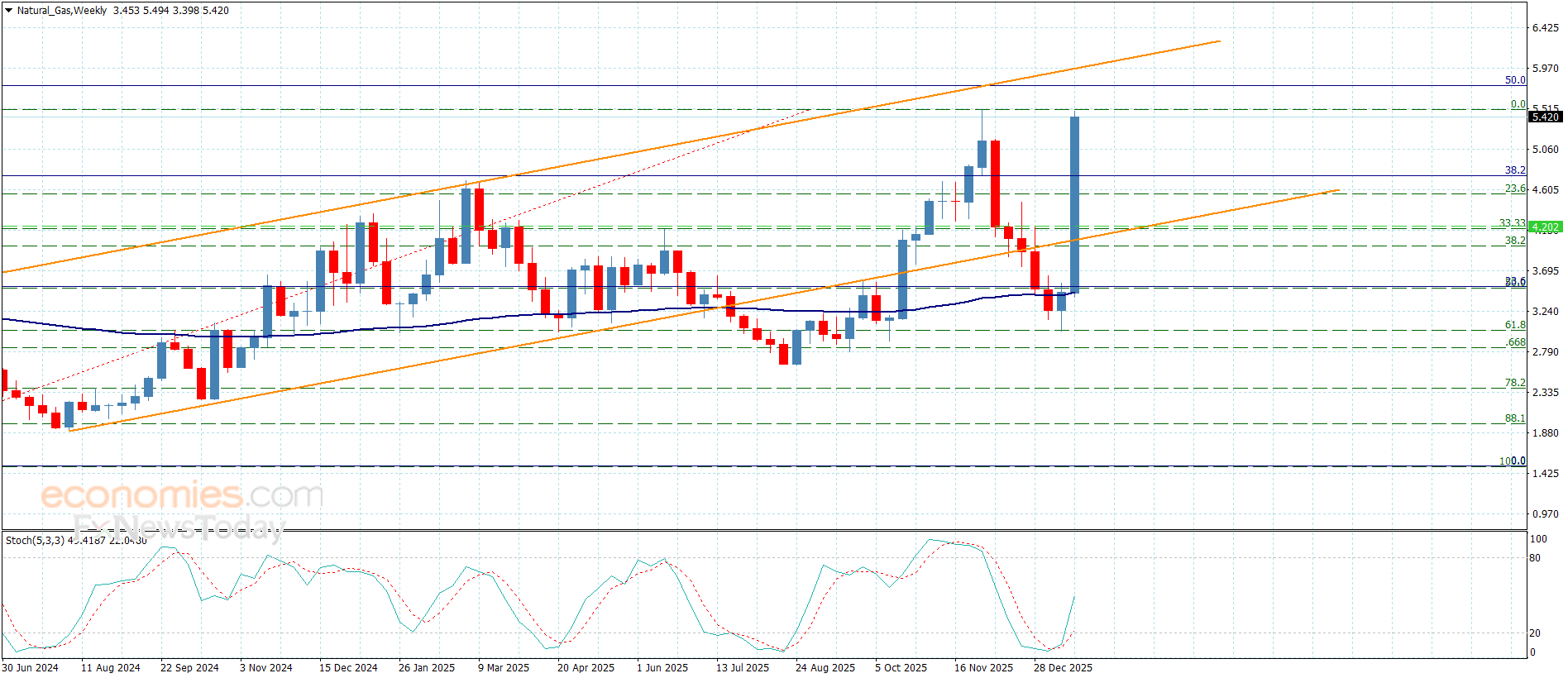

Natural gas price achieves big gains– Forecast today – 22-1-2026

Natural gas price activated with the US data positively, to rally above the broken bullish channel’s support initially at $4.050 level, to settle above it and to open the way for today’s trading with strong positivity by its rally directly to $5.490.

The price might form corrective trading to attempt to gather some gains, but its stability above $4.750 level supports the continuation of the positivity, to expect resuming the bullish attack to reach $5.770, then press on the bullish channel’s resistance at $5.960.

The expected trading range for today is between $5.100 and $5.770

Trend forecast: Bullish