Platinum price takes advantage of indicators positivity– Forecast today – 17-9-2025

AI Summary

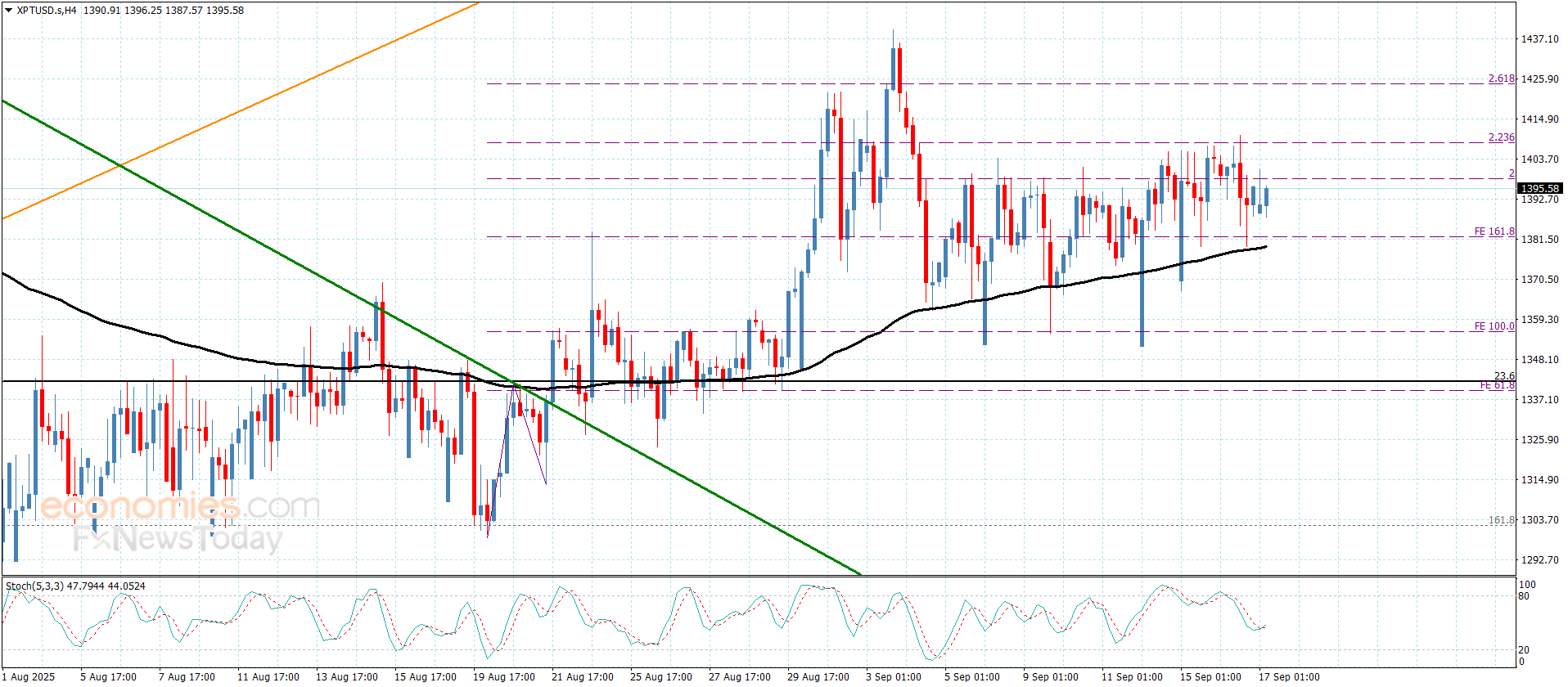

- Platinum price stability above moving average 55 reinforces support at $1382.00

- Positive momentum indicators suggest potential breach of $1408.00 obstacle

- Expected trading range for today is between $1375.00 and $1425.00 with a bullish trend forecast

Despite the weak trading of Platinum price recently, its stability above the moving average 55 reinforces the stability of the extra support at $1382.00, besides stochastic attempt to provide positive momentum, these factors assist confirming the continuation of the positivity, to keep waiting for breaching the obstacle of $1408,00 to ease the mission of achieving the main targets that begin at $1435.00.

The risk of changing the main trend is represented by attempting to break the critical support at $1355.00, forcing it to form strong bearish waves, to expect reaching $1302.00 initially reaching to 38.2%Fibonacci correction level at $1255.00.

The expected trading range for today is between $1375.00 and $1425.00

Trend forecast: Bullish

Copper price moves within the bullish trend– Forecast today – 17-9-2025

Copper price returned to form sideways trading, due to its stability below $4.6200 level, attempting to gather extra positive momentum to reinforce the dominance of the suggested bullish bias.

Note that the main stability within the bullish channel’s levels, and the continuation of forming extra support at $4.2600, these factors support the continuation of the positive trading, which might target $4.7500, and surpassing this barrier might extend the trading towards new bullish stations, which makes $4.9500 represents our initial extra target for the bullish track.

The expected trading range for today is between $4.5000 and $4.7500

Trend forecast: Bullish

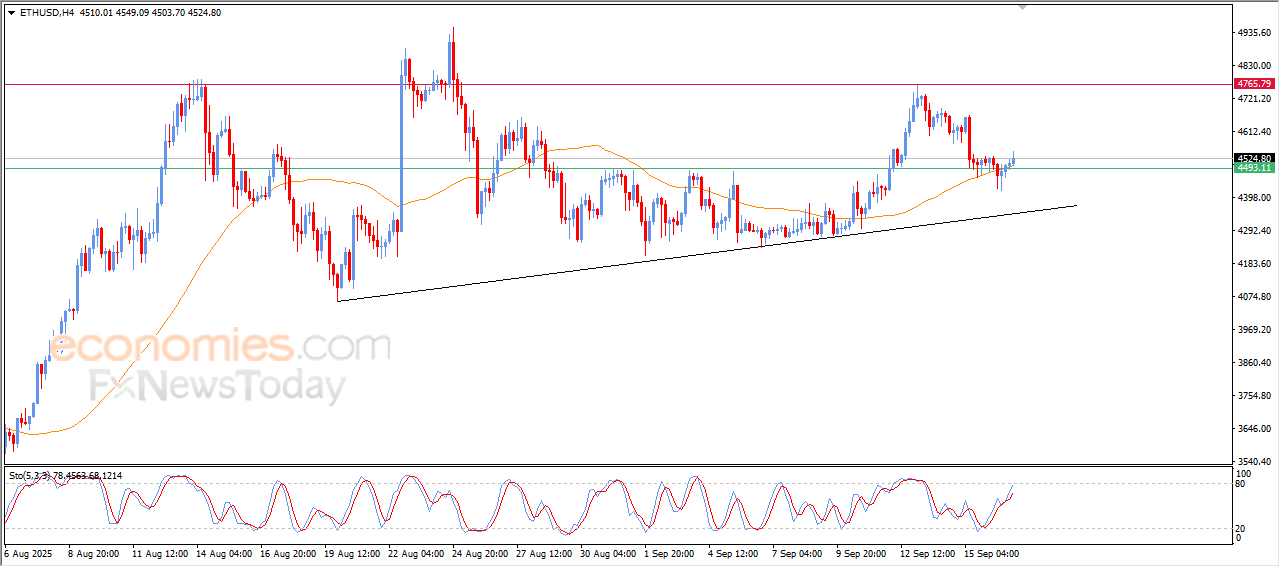

The (ETHUSD) keeps the positive trend- Analysis- 17-09-2025

The (ETHUSD) price rose in its last trading on the intraday levels, taking advantage of the dynamic support that is represented by its trading above EMA50, besides the stability of the critical support at $4,490, gaining bullish momentum that helped it to achieve these last gains, especially with the emergence of the positive signals on the relative strength indicators, however they entered exaggerated overbought levels compared to the price movement, which might decelerate the gains on the near-term basis, all that comes amid the dominance of the bullish trend on the short-term basis and its trading alongside minor trendline.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

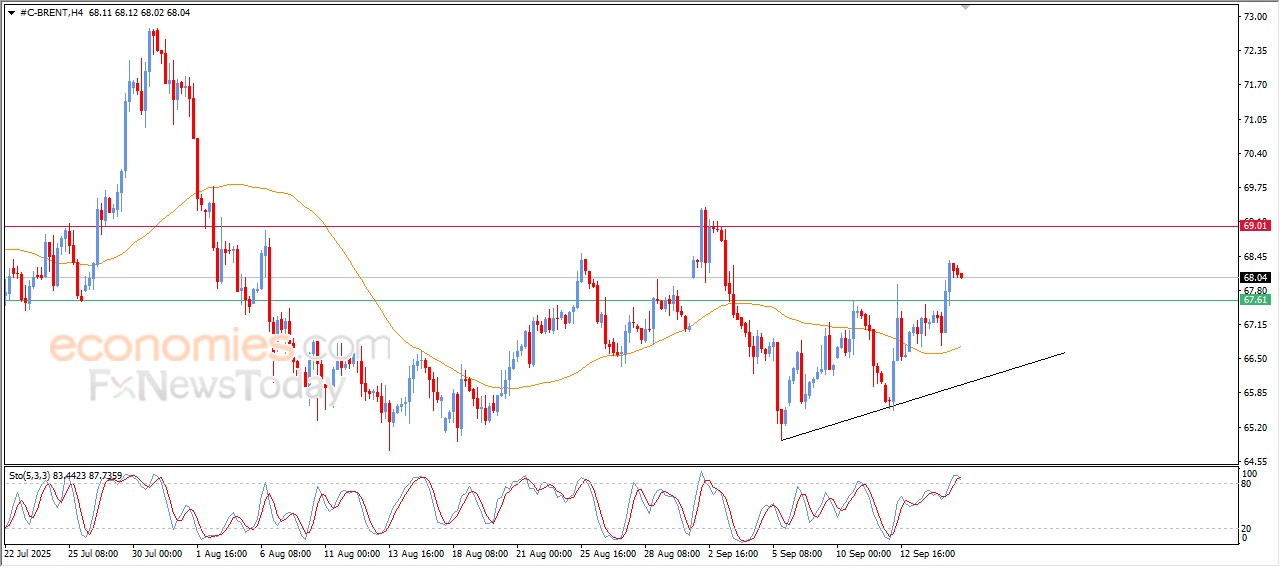

Brent crude oil gathers its positive strength- Analysis-17-09-2025

The (Brent) price declined in its last trading on the intraday levels, with the emergence of the negative overlapping signals on the relative strength indicators, after reaching overbought levels, attempting to offload some of this overbought condition, which might provide extra bullish momentum that help it to resume its strong gains, these declines represent healthy sign for gathering the gains of its previous rises, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside trendline, with the stability of its trading above the critical resistance at $67.60, which confirms breaching it and reinforcing the positive signals in the upcoming period.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025: