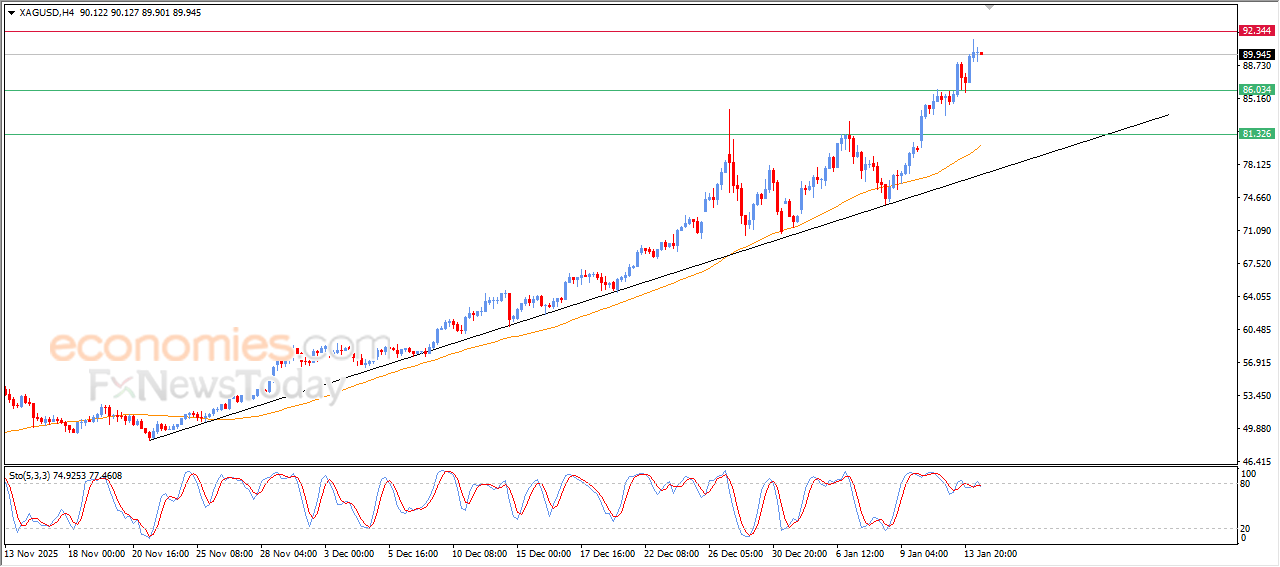

Forecast update for silver -14-01-2026

The price of (silver) fluctuated on its last intraday levels, attempting to gain bullish momentum that might help it to resume its strong gains in the upcoming period and recording new historical levels, attempting to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of negative overlapping signals, amid the continuation of the positive pressure due to its trading above EMA50, reinforcing the dominance and the stability of the main bullish track on the short-term basis.

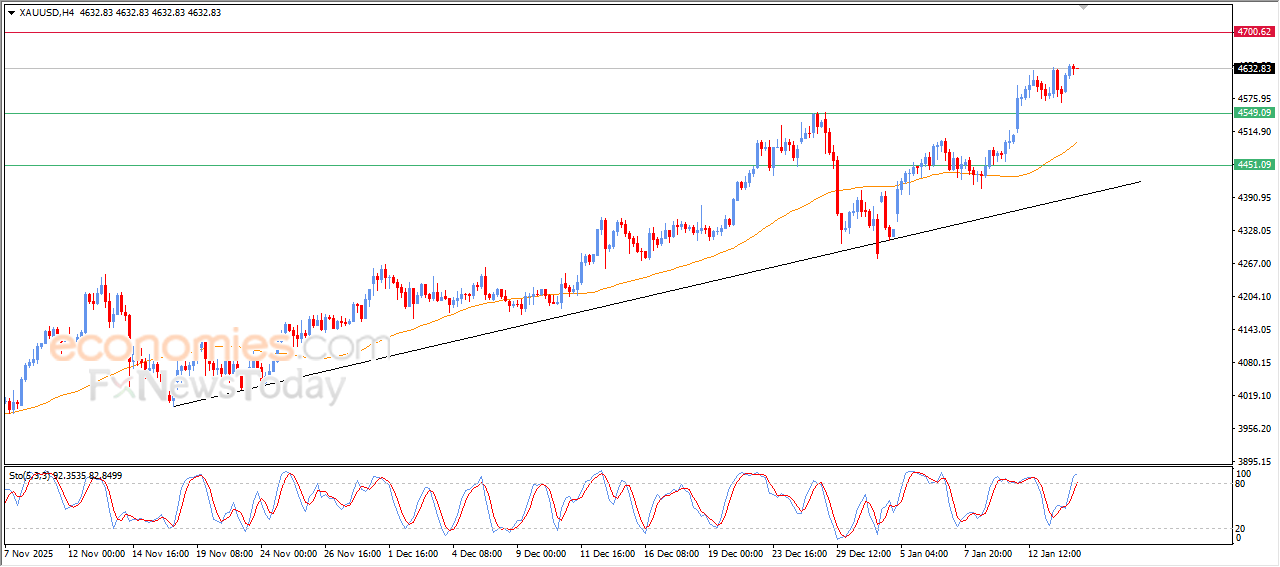

Forecast update for Gold -14-01-2026.

The price of gold (GOLD) settles on limited gains on its last intraday levels, attempting to gain bullish momentum that might help it to record new all-time highs, amid the dominance of the main bullish trend on the short-term basis, with its trading alongside supportive trendline for this trend, despite reaching overbought levels, accompanied by the dynamic support that is represented by its trading above EMA50, providing renewed bullish momentum.

Forecast update for EURUSD -14-01-2026.

The price of (EURUSD) rose in its last intraday trading, attempting to recover some previous losses, attempting to offload some of its clear oversold conditions on the relative strength indicators, especially with the emergence of the positive signals, this performance comes amid the trading with bearish corrective channel’s range that limits its previous trading on the short-term basis, with the continuation of the negative pressure due to its trading below EMA50, reducing the chances of achieving full recovery on the near term basis.

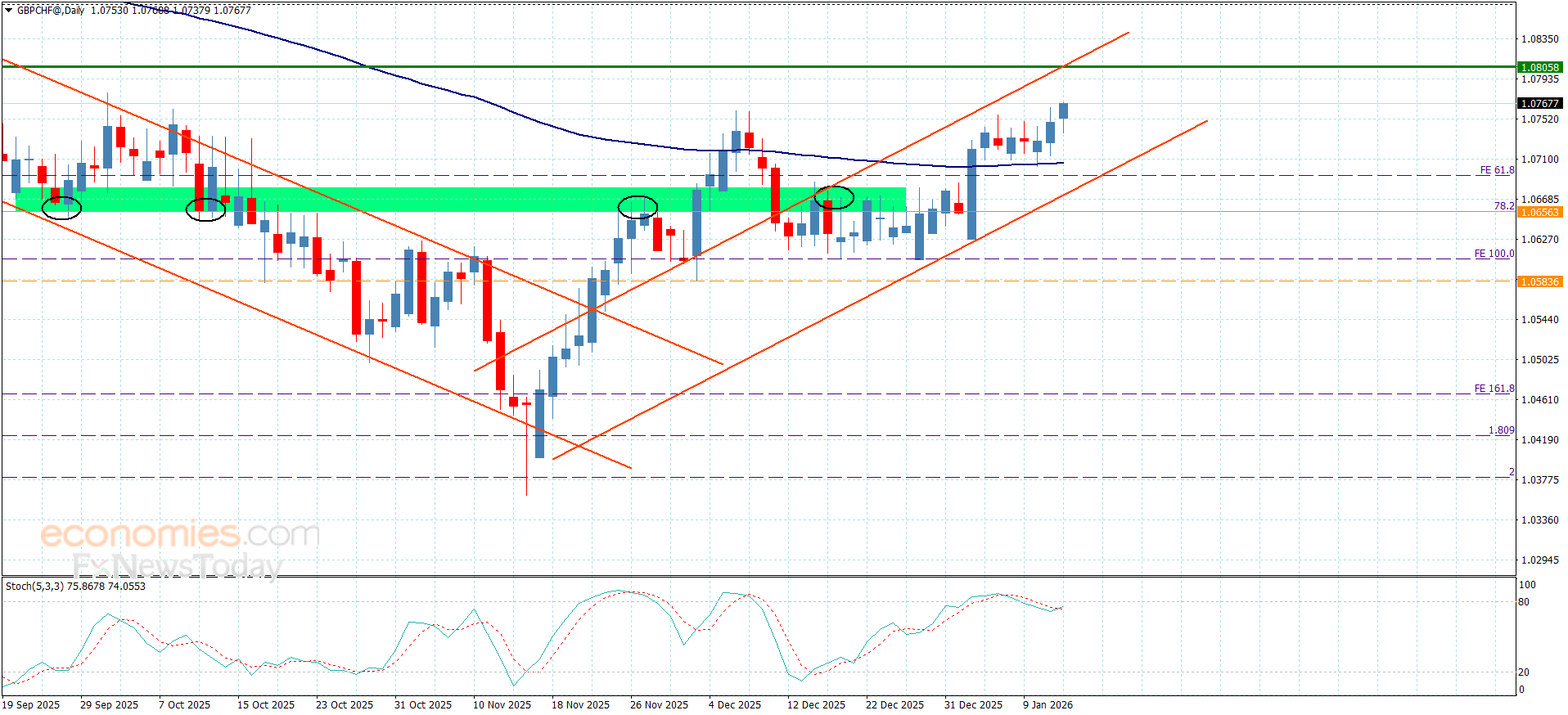

The GBPCHF keeps rising– Forecast today – 14-1-2026

GBPCHF price took advantage of the main stability within the bullish channel’s levels, besides providing bullish momentum by the main indicators, which allows it to form new bullish waves, to settle near 1.0770 level.

Forming a new support base at 1.0715 level and the continuation of the positive pressures make us expect its rally towards 1.0804, to press on the bullish channel’s resistance, to find a new exit for resuming the bullish attack in the near and medium period.

The expected trading range for today is between 1.0740 and 1.0804

Trend forecast: Bullish