The EURCAD attempts to regain the bullish track– Forecast today – 14-8-2025

AI Summary

- EURCAD has repeatedly closed above the bullish channel's support at 1.5910, facing stochastic negativity and forming a positive rally towards the barrier at 1.6125.

- The stability within the bullish track indicates a preference for surpassing the current barrier to resume the bullish attack, potentially reaching gains starting at 1.6210 and extending to 1.6350.

- The expected trading range for today is between 1.6050 and 1.6210, with a bullish trend forecasted.

The EURCAD repeatedly provided positive closes above the bullish channel’s support at 1.5910 level, which allows it to face stochastic negativity and form a positive rally, attacking the barrier at 1.6125.

The stability of the price within the bullish track makes us prefer surpassing the current barrier to ease the mission of resuming the bullish attack, and achieving several gains that might begin at 1.6210 reaching 100%Fibonacci extension level near 1.6350.

The expected trading range for today is between 1.6050 and 1.6210

Trend forecast: Bullish

Natural gas price repeats the negative attempts– Forecast today – 14-8-2025

Natural gas price touched $2.792 level, to move away from the neckline of the head and shoulders at $3.050, confirming its surrender to the previously suggested bearish scenario.

Note that the continuation of providing negative momentum by the main indicators will provide a chance for breaking $2.720, to begin forming new bearish waves, to expect reaching $2.480 followed by the next support at $2.390, which forms the waited main target in the current period trading.

The expected trading range for today is between $2.480 and $2.950

Trend forecast: Bearish

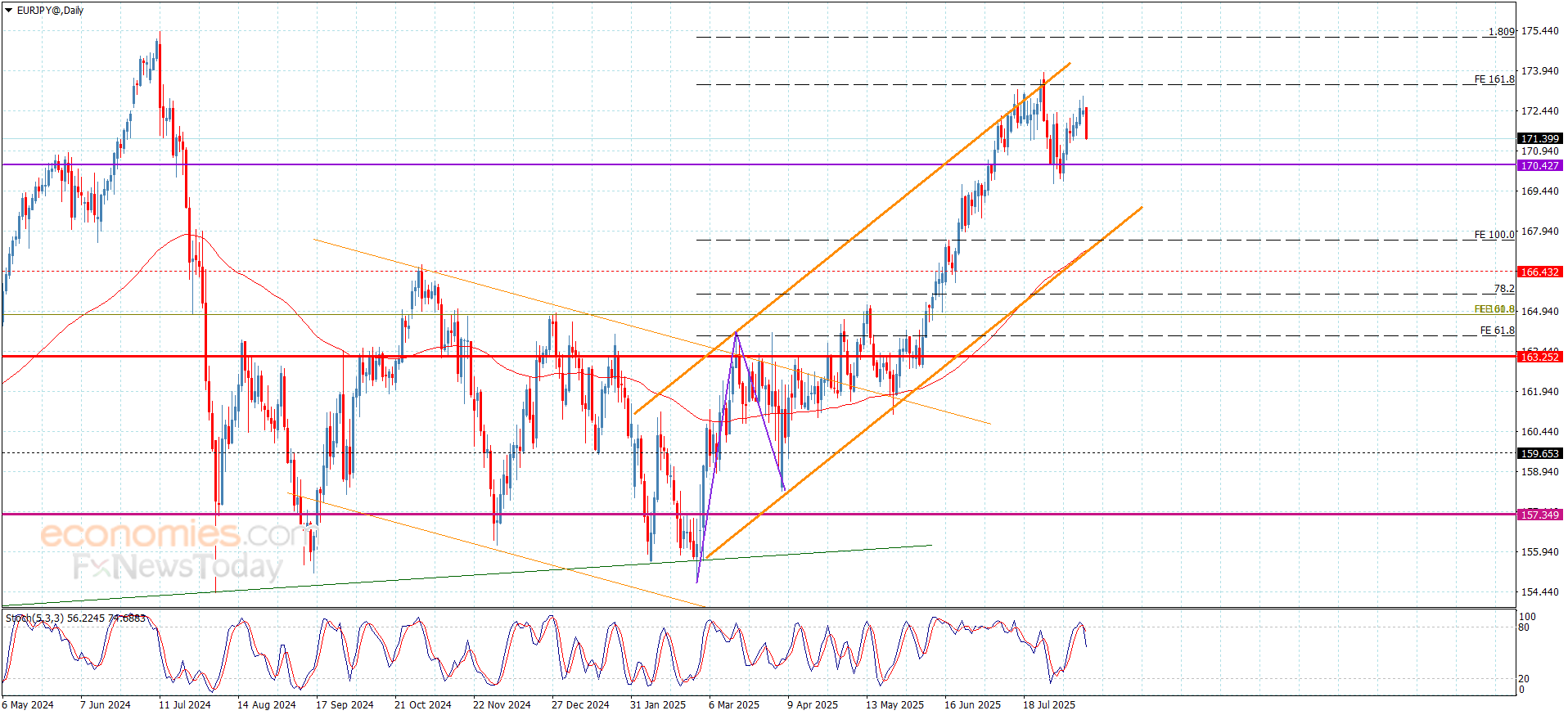

The EURJPY delays the rise– Forecast today – 14-8-2025

The EURJPY pair reacted with stochastic exit from the overbought level this morning, which forces it to delay the bullish attack to reach below 172.00, announcing its surrender to the bearish correctional scenario by its stability near 171.38.

The continuation of the negative pressure might force the price to suffer extra losses by reaching 170.90 followed by the extra support at 170.45, while the price return to settle above 172.00 will provide chances for renewing the bullish attempts and reaching 172.60.

The expected trading range for today is between 170.45 and 172.60

Trend forecast: Bearish temporarily

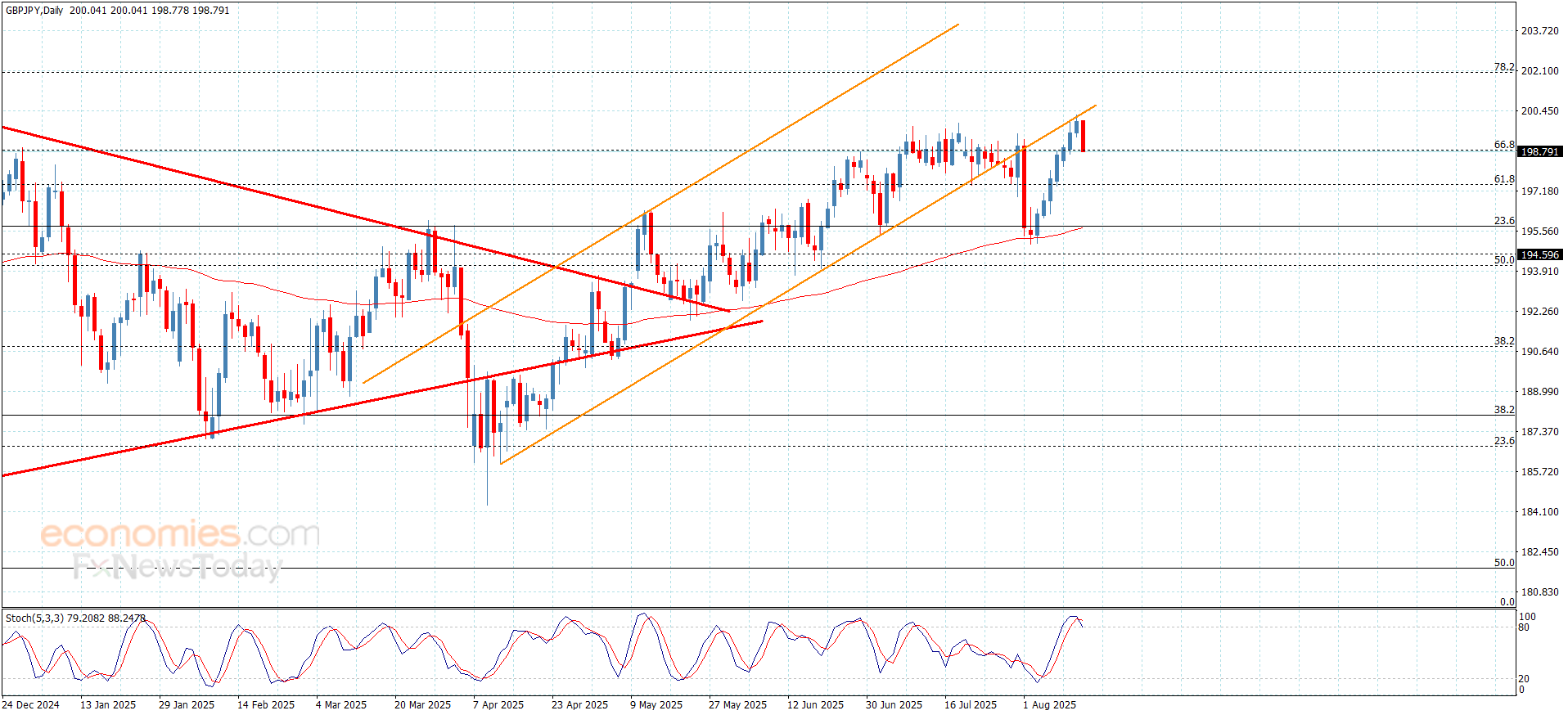

The GBPJPY surrenders to the stability of the resistance– Forecast today – 14-8-202

The GBPJPY pair surrendered this morning trading due to the stability of the resistance at 200.40, to form a strong obstacle against the attempt to return to the bullish channel’s levels, forming strong correctional decline and its stability near 198.77.

Stochastic attempt to exit the oversold level makes us expect renewing the correctional attempts, note that breaking 198.25 level will force it to suffer extra losses that might extend to 61.8%Fibonacci correction level at 197.55, while the stability above 198.25 will increase the chances for renewing the bullish attempts in the near period.

The expected trading range for today is between 198.25 and 199.60

Trend forecast: Bearish