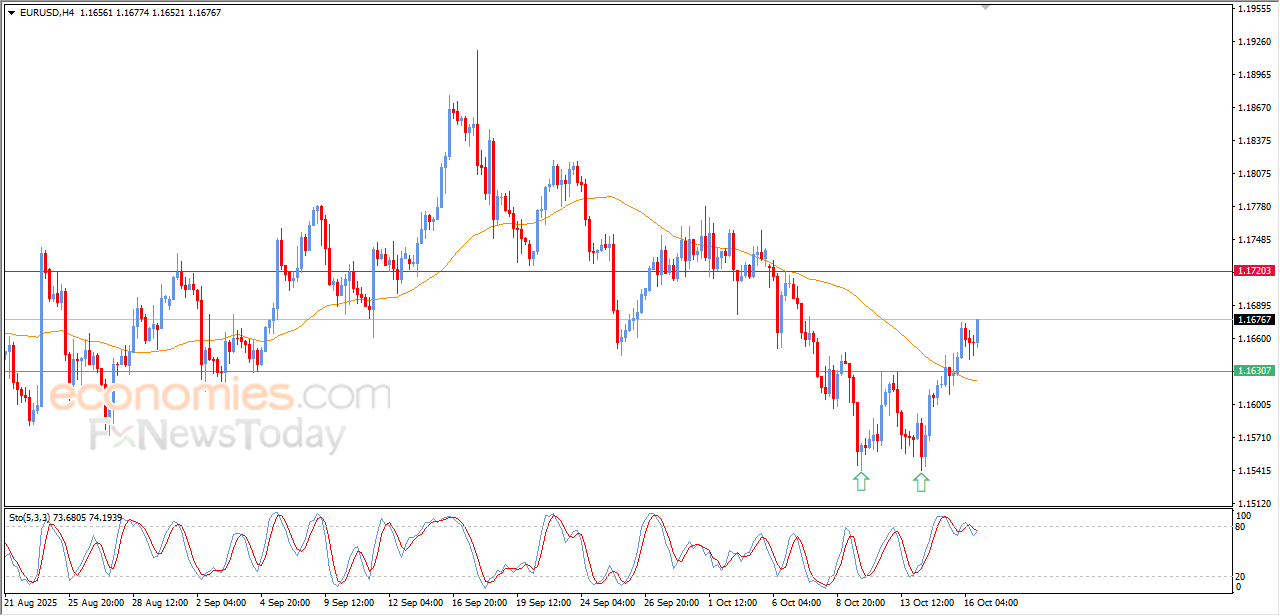

Evening update for EURUSD -16-10-2025

The (EURUSD) rose in its last intraday trading, amid the continuation of the positive pressure due to its trading above EMA50, affected by a short-term bullish technical formation, which is represented by the double bottom pattern, after offloading the overbought conditions on the relative strength indicators, opening the way for achieving more gains.

VIP Trading Signals Performance by BestTradingSignal.com (6-10 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 6-10, October 2025:

Solana price buoyed by pivotal support - Analysis - 16-10-2025

Solana (SOLANA) advanced in its latest intraday trading after stabilizing at the key support level of 191.55$, which provided some positive momentum helping it achieve recent gains. Positive signals have begun to appear from the relative strength indicators after reaching oversold areas. However, ongoing negative pressure from trading below the 50-day SMA reduces the chances of a near-term recovery, while the short-term corrective bearish trend remains dominant, with trading along a descending line that supports this path.

Therefore, we expect the cryptocurrency to decline in its upcoming intraday trading, especially if it breaks below the mentioned support level of 191.55$, targeting the next support level at 175.95$.

Today’s price forecast: Bearish.

WLD price moves in a tight sideways range - Analysis - 16-10-2025

WLD (WLDUSD) showed narrow sideways movements in its latest intraday trading, under continued negative pressure from trading below the 50-day SMA and within the dominance of the main short-term bearish trend, moving along a descending line. However, positive signals are appearing from the relative strength indicators, which have helped limit the cryptocurrency’s decline over the past period.

Therefore, we expect the cryptocurrency to decline in its upcoming intraday trading as long as the resistance level of 1.16815322 holds, targeting the key support level of 0.85800989, with strong chances of breaking below it.

Today’s price forecast: Bearish.

C3.ai price shows more positive signs - Forecast today - 16-10-2025

C3.ai, Inc (AI) stock advanced slightly in its latest intraday trading, under the influence of a short-term corrective bullish wave and supported by continued trading above the previous 50-day SMA, which provides dynamic support that reinforces the positive outlook around the stock. This comes alongside the formation of a positive divergence on the relative strength indicators after reaching excessively oversold levels compared to the price movement, with positive signals starting to appear from them.

Therefore, we expect the stock to rise in its upcoming trading sessions, especially as long as it remains above 18.64$, targeting the resistance level of 23.75$.

Today’s stock forecast: Bullish.