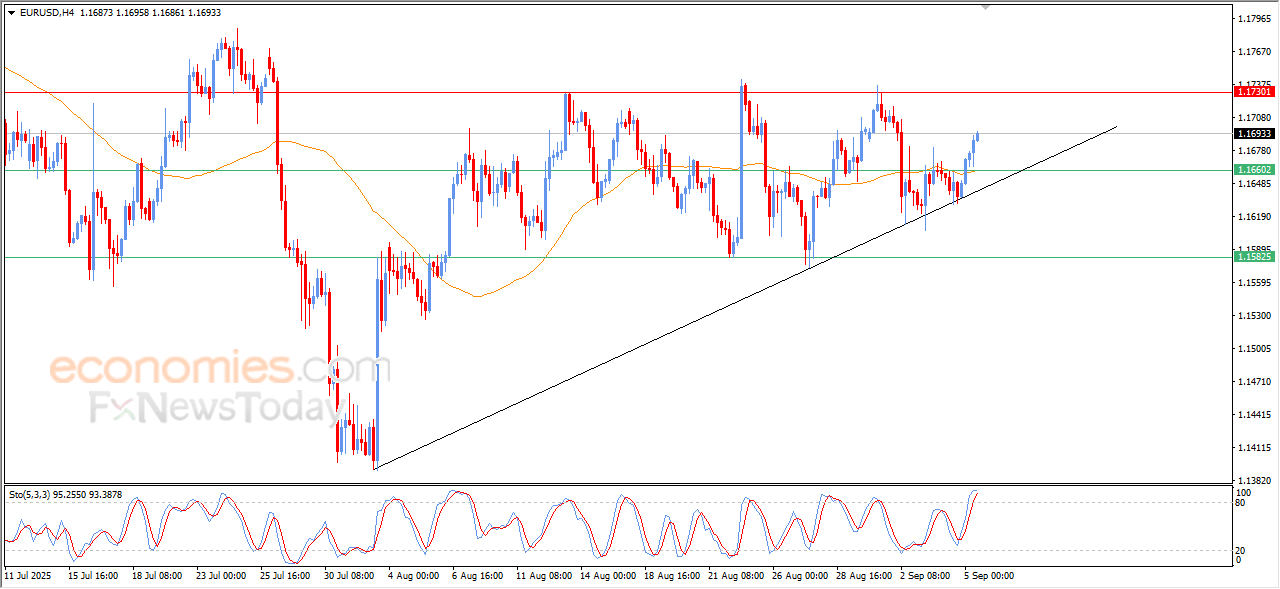

Forecast update for EURUSD -05-09-2025.

AI Summary

- EURUSD price extended gains in last trading session, surpassing negative pressure of EMA50

- RSI reached overbought levels with negative signals, potentially reducing gains in near-term

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets

The price of (EURUSD) extended its gains in its last intraday trading, to succeed in surpassing the negative pressure of the EMA50, under the dominance of minor bullish wave on the short-term basis and its trading alongside a supportive bias line for this track, on the other hand, the (RSI) reached overbought levels, with the emergence of negative overlapping signals from there, which might reduce the gains on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

The GBPAUD keeps the positivity– Forecast today – 5-9-2025

The GBPAUD repeated providing positive closes above 23.6%Fibonacci correction level at 2.0510, announcing its readiness to renew the bullish attempts to attack the moving average 55 at 2.0610.

By the above image, we notice stochastic exit from the oversold level, providing strong chance to gain the required positive momentum to surpass the moving average 55, then begin recording the targets by its rally towards 2,0740, while breaking the current support will force it to resume the correctional decline, which forces it to suffer extra losses by reaching 2.0455 and 2.0330.

The expected trading range for today is between 2.0540 and 2.0740

Trend forecast: Bullish

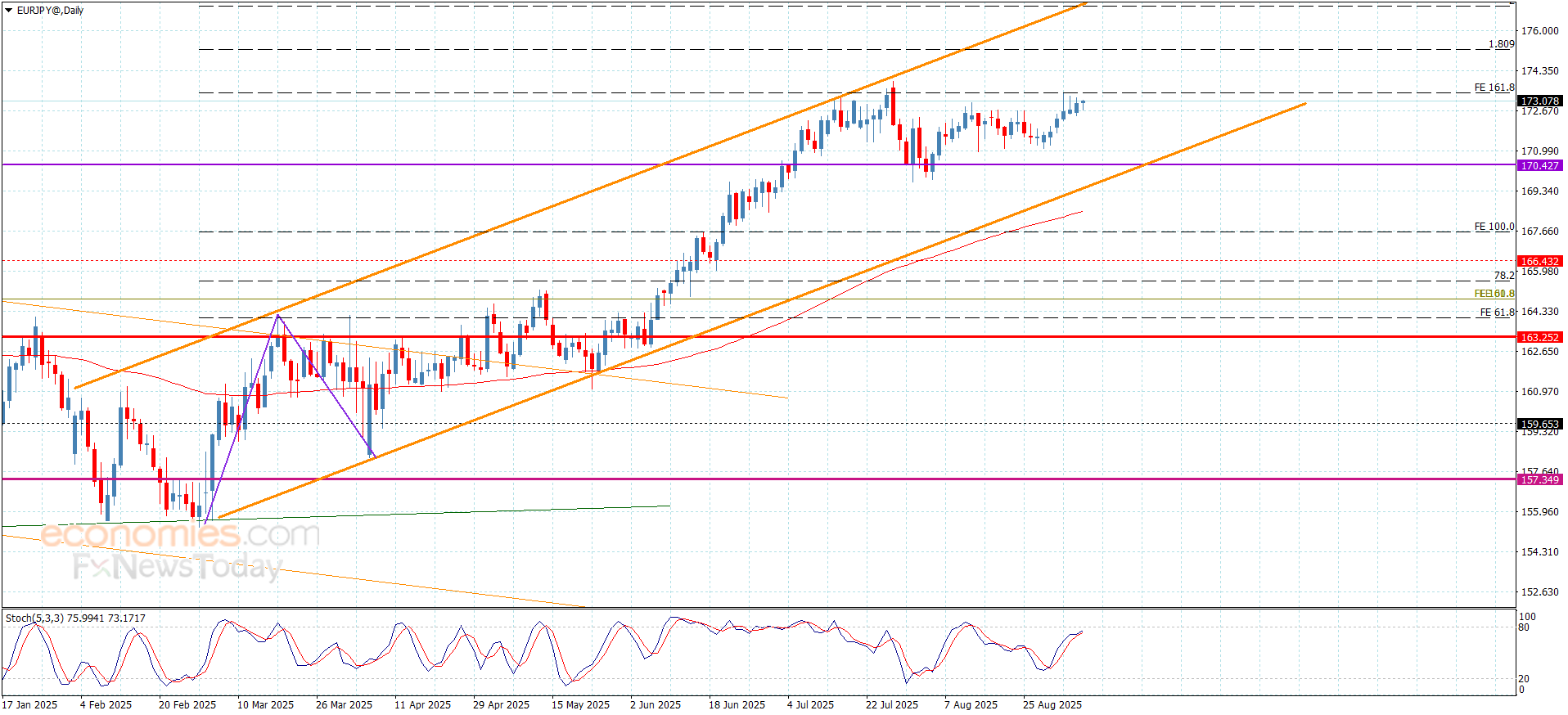

The EURJPY is without any news– Forecast today – 5-9-2025

The EURJPY pair remains affected by the stability of the barrier at 173.40, forming a strong obstacle against the attempts to resume the bullish attack in the current trading, to keep preferring the bearish correctional bias, to target 172.20 level reaching the extra support at 171.30.

While facing strong positive pressures and its rally above the barrier will confirm its readiness to resume the bullish attack, to begin recording new gains by reaching 174.20 followed by 1.809%Fibonacci extension level at 175.20.

The expected trading range for today is between 171.85 and 173.40

Trend forecast: Fluctuated within the bullish track

The GBPJPY remains below the barrier– Forecast today – 5-9-2025

The GBPJPY pair attempted to face the attempts of activating the bearish correctional track, taking advantage of providing positive momentum by stochastic, but it didn’t make it surpass the barrier at 200.40, to keep providing mixed sideways trading by its stability near 199.50.

The expected trend depends on the strength of the mentioned barrier, the continuation of the price stability below it will increase the chances of activating the negative attempts that might target 198.60 level, reaching the support at 197.85, while breaching the barrier and holding above it will activate the bullish track, to reach 200.90 followed by the next positive target at 202.45.

The expected trading range for today is between 197.85 and 199.80

Trend forecast: Bearish