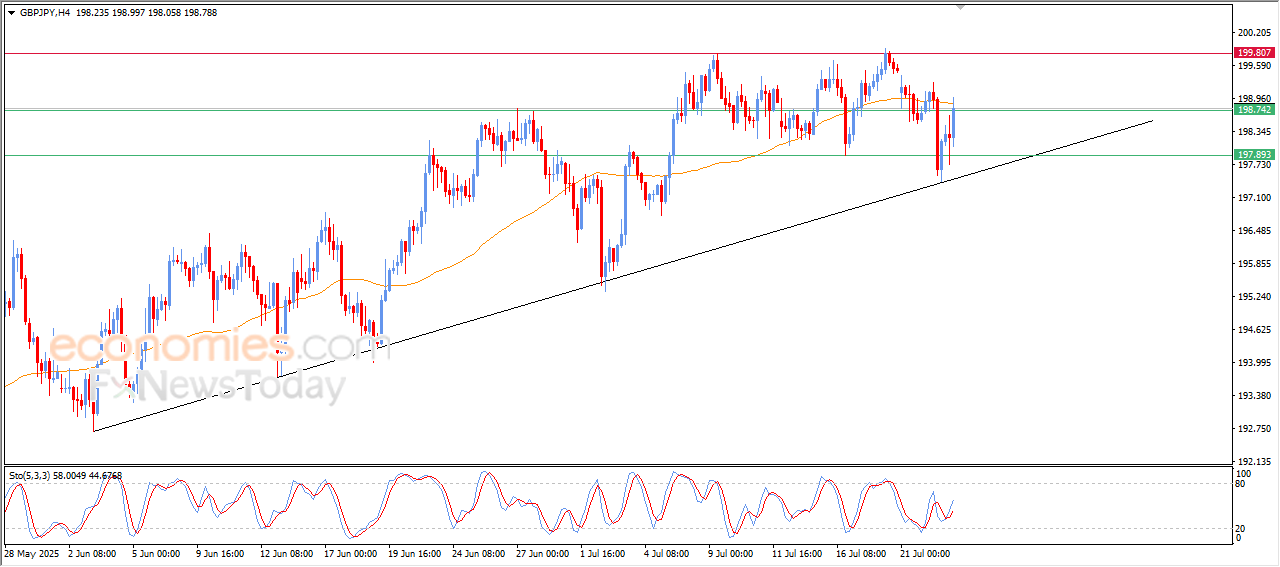

The GBPJPY soars high– Forecast today – 23-7-2025

AI Summary

- GBPJPY pair soars high in last intraday trading, supported by positive signals on RSI and attempting to get rid of negative pressure of EMA50

- Expectations suggest rise in GBPJPY, especially when breaching resistance at 198.75 to target critical resistance level at 199.80

- Trend forecast is bullish, with expected trading range between 197.90 support and 199.80 resistance

The GBPJPY pair soars high in the last intraday trading, supported by the emergence of the positive signals on the (RSI), after reaching oversold levels, attempting to get rid of the negative pressure of the EMA50, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a supportive bias line for the trend.

Therefore, our expectations suggest a rise of (GBPJPY) in its upcoming intraday trading, especially when breaching the current resistance at 198.75, to target the critical resistance level at 199.80.

The expected trading range for today is between 197.90 support and 199.80 resistance

Trend forecast: Bullish

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

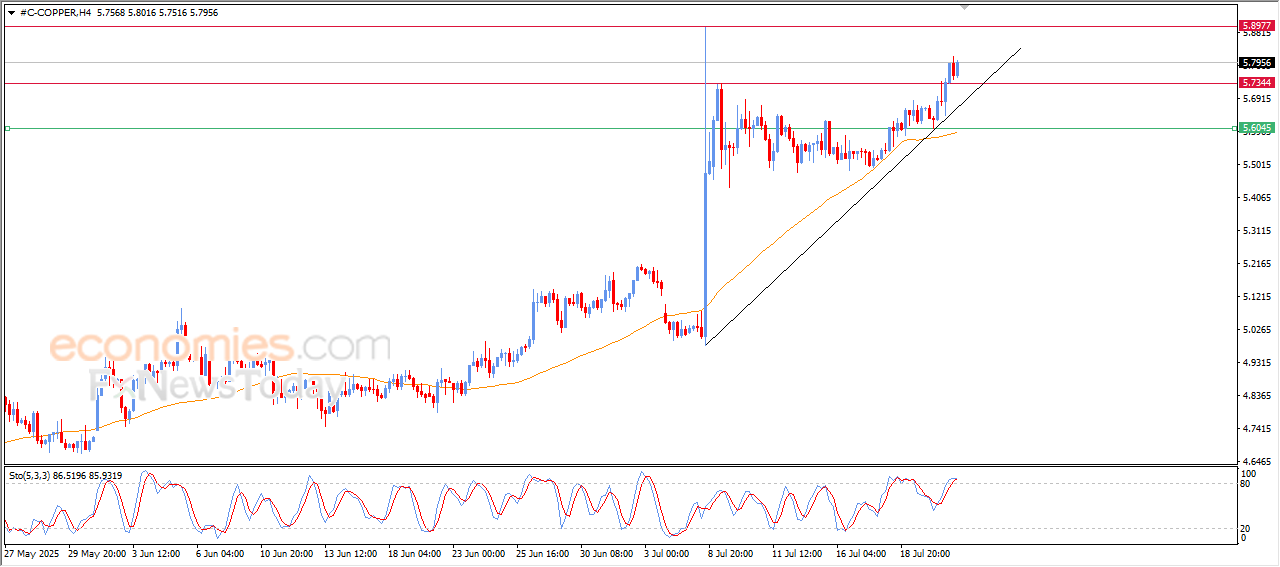

Copper price breaches its resistance– Forecast today – 23-7-2025

Copper price witnessed a strong rise in its last intraday trading, to breach the key resistance at $5.73, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a minor bias line, with the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the stability of this bullish track, especially with the emergence of the positive signals on the (RSI), despite reaching overbought areas.

Therefore, our expectations suggest a rise in (copper) price in its upcoming intraday trading, if it settles above $5.73, to target the critical resistance level at $5.89.

The expected trading range for today is between $5.65 and $5.89

Trend forecast: Bullish

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

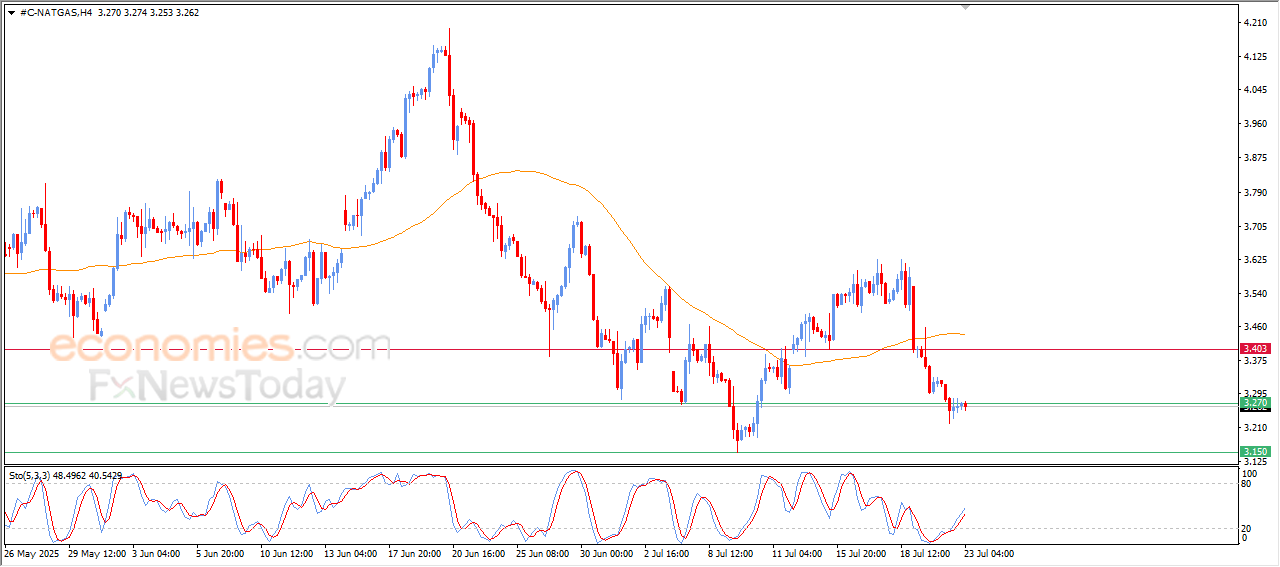

Natural gas price losses the bullish momentum temporarily – Forecast today – 23-7-2025

Natural gas price settled in its last intraday trading, to recover some of its previous losses and offload its oversold conditions on the (RSI), to reach exaggerated overbought conditions compared to the price move, amid the dominance of the main bearish trend on the short-term basis, with the continuation of the negative pressure due to its trading below EMA50, reinforcing the bearish track.

Therefore, our expectations for natural gas prices suggest a decline in its upcoming intraday trading, especially when breaking the current support at $3.25, to target the critical support level at $3.15

The expected trading range for today is between $3.15 support and $3.35 resistance

Trend forecast: Bearish

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025

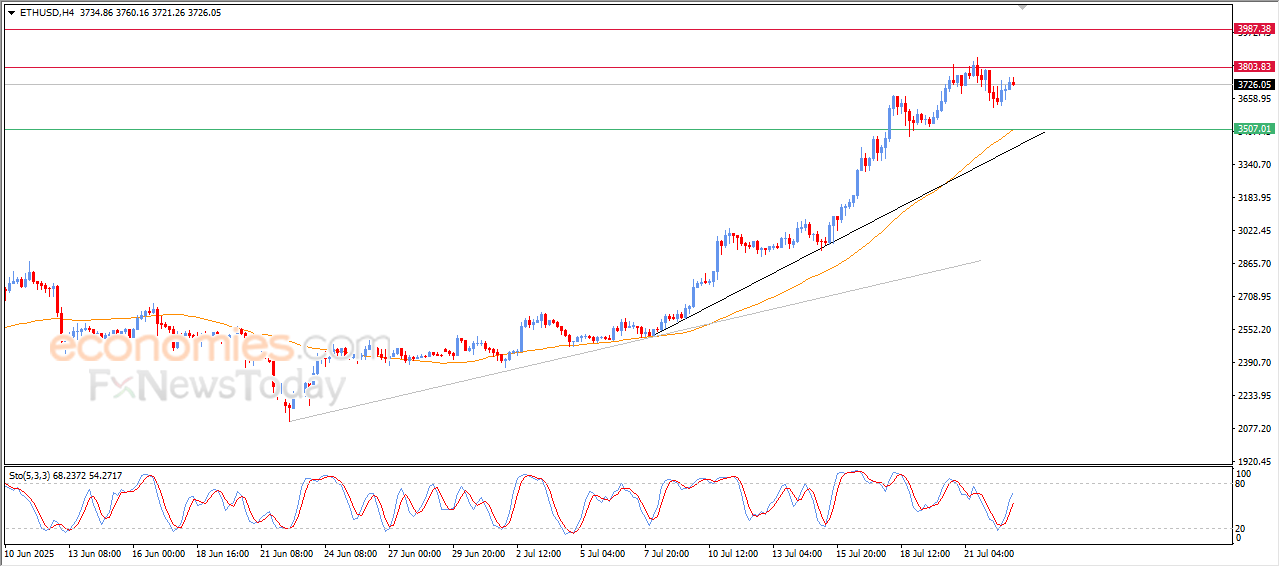

The (ETHUSD) is surrounded by positive pressure-Analysis- 23-07-2025

The (ETHUSD) price settled high in its last intraday trading, preparing to attack the critical resistance level at$3,800, supported by its continued trading above EMA50, which forms a dynamic support that reinforces the positive track, especially amid the dominance of the main bullish trend on the short-term basis and its trading alongside main and minor bias lines, with the emergence of the positive signals on the (RSI), after reaching oversold levels.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Trading Signal Results – Week of July 14–18, 2025