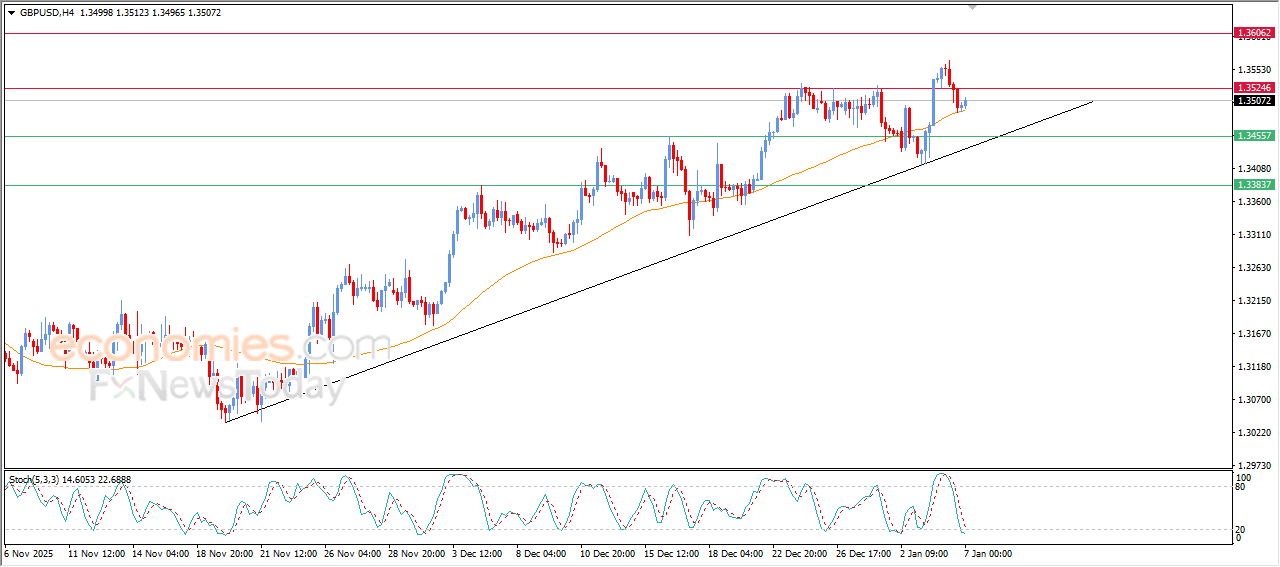

GBPUSD price is getting positive support- Analysis- 07-01-2026

GBPUSD rose in its last intraday trading, due to its leaning on EMA50’s support, gaining bullish momentum that helped it achieve these gains, preparing to reach the stubborn resistance at 1.3525, amid the dominance of the main bullish trend on the short-term basis and its trading alongside supportive trend line, with the emergence of positive overlapping signals on the relative strength indicators, after reaching oversold levels exaggeratedly compared to the price move, indicating a beginning of forming positive divergence.

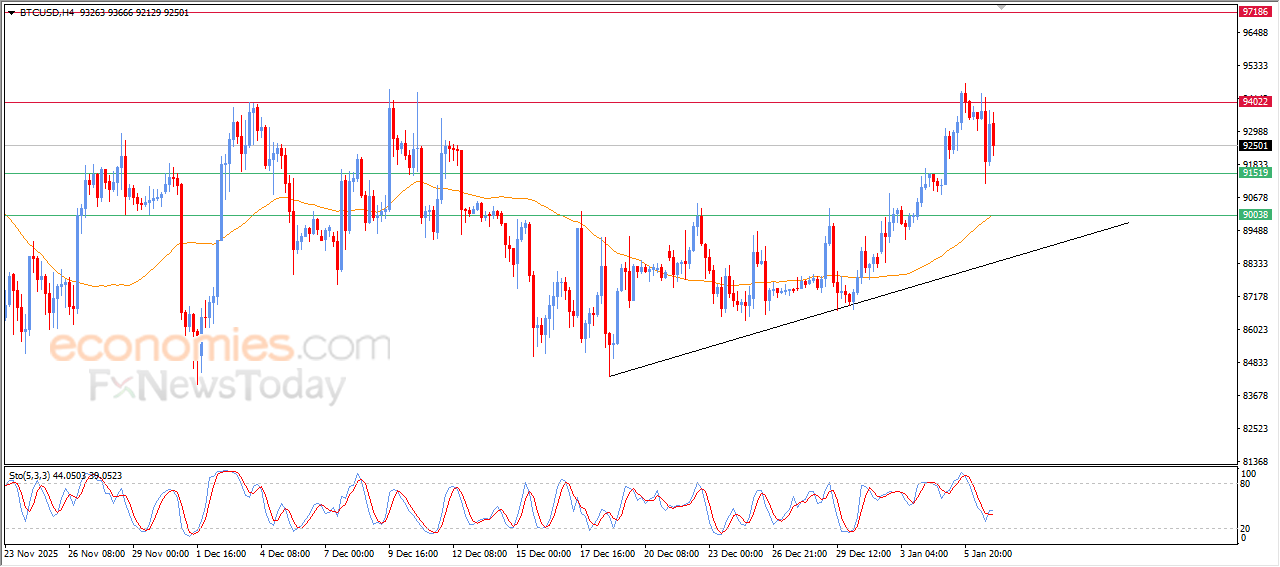

(BTCUSD) attempts to gain bullish momentum- Analysis-07-01-2026

Bitcoin’s price is experiencing fluctuated trading in its last intraday trading, amid the stability of the key resistance at $94,000, where it attempts to gain bullish momentum that might allow it to breach this barrier, supported by the dominance of the main bullish trend on the short-term basis and its trading alongside supportive trend line for this track.

The positive scenario is reinforced by the continuation of the dynamic support that comes from the trading above EMA50, besides the emergence of positive overlapping signals on the relative strength indicators after reaching exaggerated oversold levels compared to the price move, to indicate forming positive divergence that might support the recovery chances and testing higher levels in the near-period.

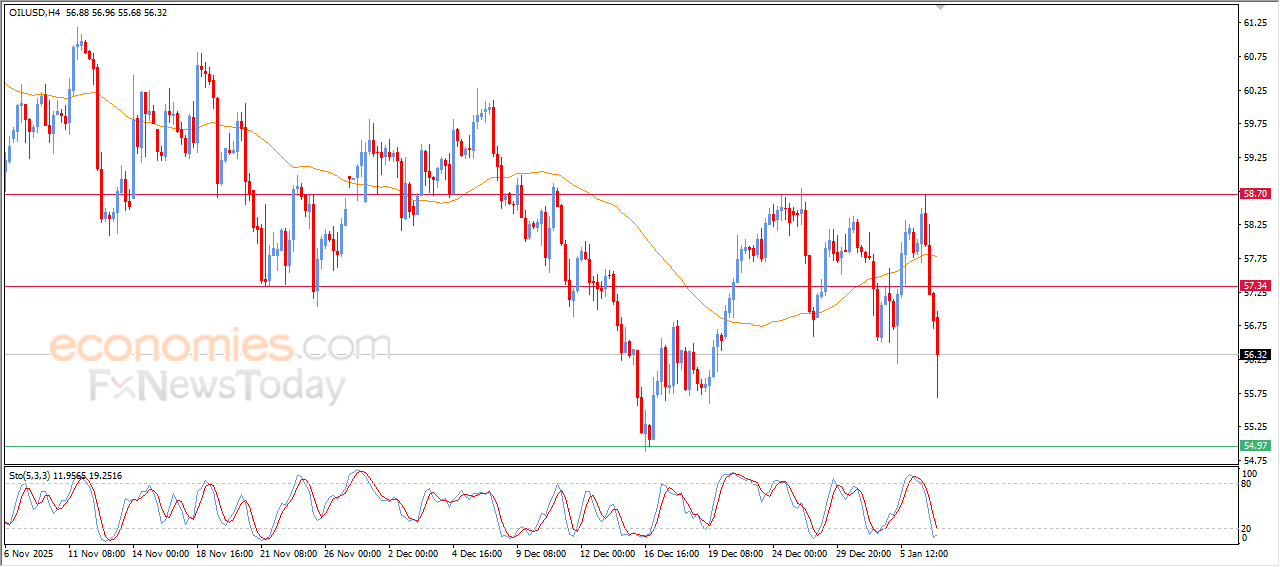

Crude oil price is slipping lower- Analysis-07-01-2026

Crude oil continued its sharp decline in its recent intraday trading, affected by the continuation of the negative pressure due to its trading below EMA50, indicating the weak momentum and imposes clear restrictions on any bullish rebound attempts currently.

This negative performance is accompanied by the negative signals from the relative strength indicators, despite reaching oversold levels, indicating the continuation of the selling pressures dominance amid the dominance of the main bearish trend on the short-term basis, anticipating any technical signals that may threaten any upcoming attempts to settle.

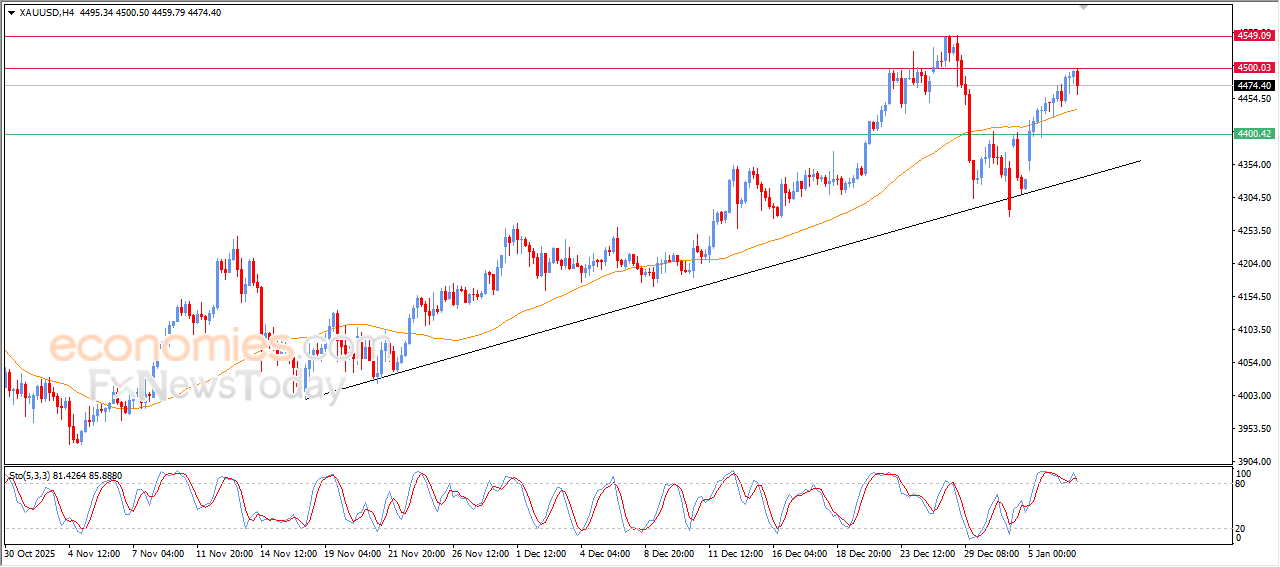

Gold price is declining to reach our expected target- Analysis-07-01-2026

Gold declined in its recent intraday trading, affected by the stability of the main resistance at $4,500, which represents expected target in our previous analysis, to enter correction range to attempt to gain bullish momentum.

The price is moving under the dominance of the main bullish trend on the short-term basis, with the trading alongside supported trend line for this track, besides the trading above EMA50, providing key dynamic support, however the beginning of negative overlapping signals appearance on the relative strength indicators suggest forming negative divergence that might push for bearish corrective rebounds on the intraday basis.