The USDCHF price amid negative forecasts- Analysis-17-09-2025

AI Summary

- USDCHF price rose in last intraday trading, but remains stable below critical support at 0.7875

- Main bearish trend continues on short-term basis, with attempt to recover previous losses

- VIP Trading Signals available for US Stock, Crypto, Forex, and VIP Signals for Gold, Oil, Forex, Bitcoin, Ethereum, and Indices starting at €44/month

The (USDCHF) price rose in its last intraday trading, despite these slight gains, it remains stable below the critical support at 0.7875, to confirm breaking it and intensifies the negative pressures, amid the continuation of the main bearish trend on the short-term basis, and its last rise came as an attempt to recover some of previous losses, attempting to offload its clear oversold conditions on the relative strength indicators, especially with the emergence of positive signals from them.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

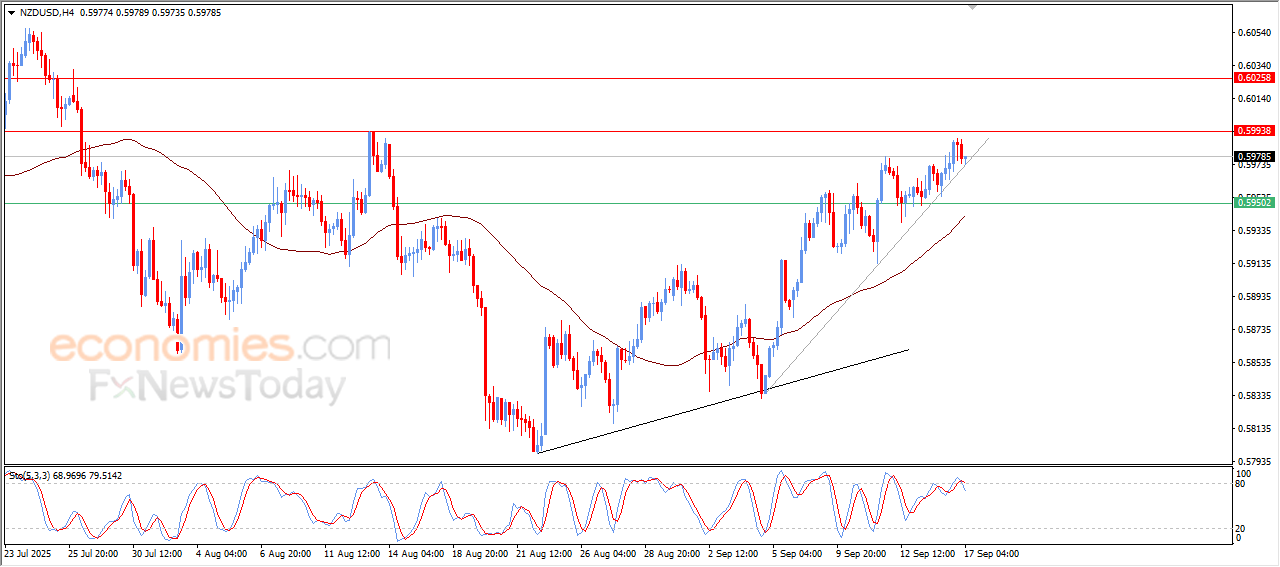

NZDUSD attempts to offload its overbought conditions -Analysis-17-09-2025

The (NZDUSD) price declined in its last intraday trading, attempting to gain bullish momentum that might hep it to recover and rise again, and attempts to offload some of its clear overbought condition on the relative strength indicators, especially with the emergence of the negative signals, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside main and minor bias lines, reinforcing the stability of this track, especially with the continuation of the dynamic support that is represented by its trading above EMA50, reinforcing the chances for the price recovery.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

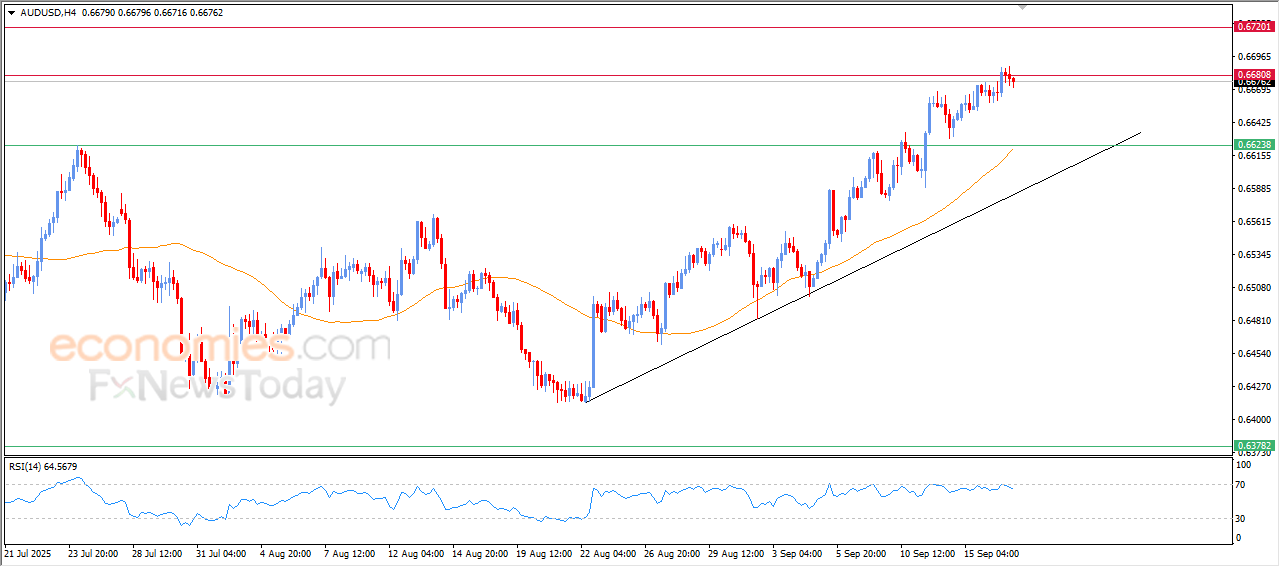

The AUDUSD price is gathering its positive strength- Analysis-17-09-2025

The (AUDUSD) price declined in its last trading on its intraday levels, due to the stability of the current resistance level at 0.6680, gathering the gains of its previous rises, and attempts to offload some of its clear overbought conditions on the relative strength indicators, especially with the emergence of the negative signals from them, to gather its positive strength that may supports its recovery and breaches this resistance, amid the dominance of the main bullish trend on the short-term basis and its trading alongside supportive trendline for this track.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

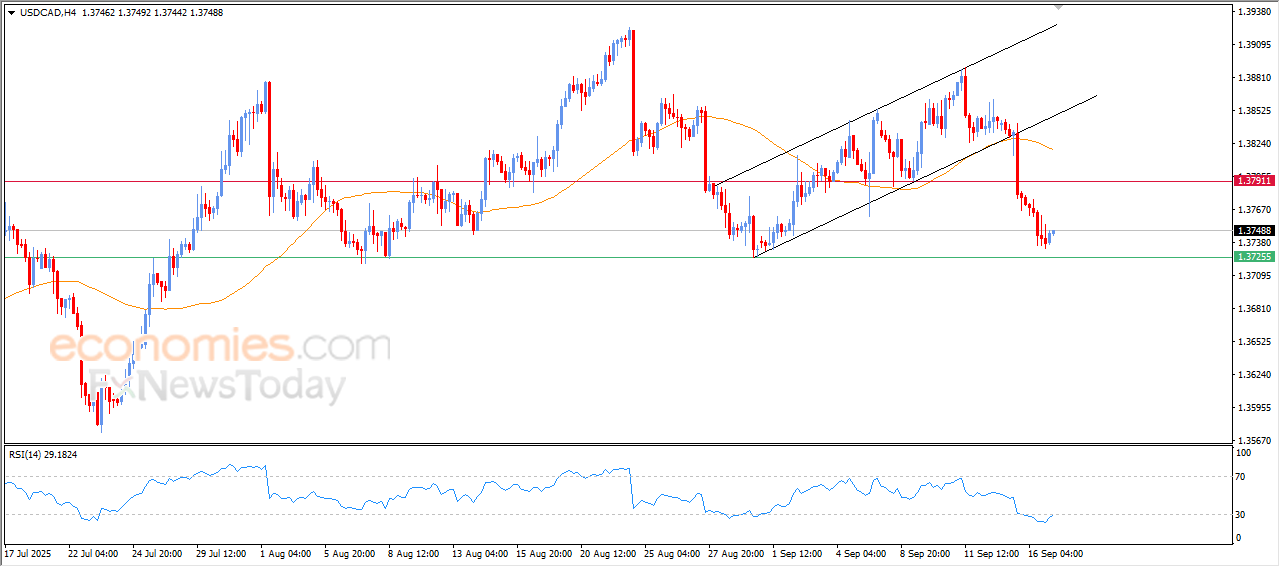

The USDCAD is attempting to offload some of its losses- Analysis-17-09-2025

The (USDCAD) price rose in its last intraday trading, due to the continuation of the negative pressure that comes from its trading below its EMA50, affected by its exit from bullish channel’s range that was confining the trading on the short-term basis, attempting to recover some of the previous losses, to attempt to offload some of its oversold conditions on the relative strength indicators, especially with the emergence of the positive signals from them.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025: