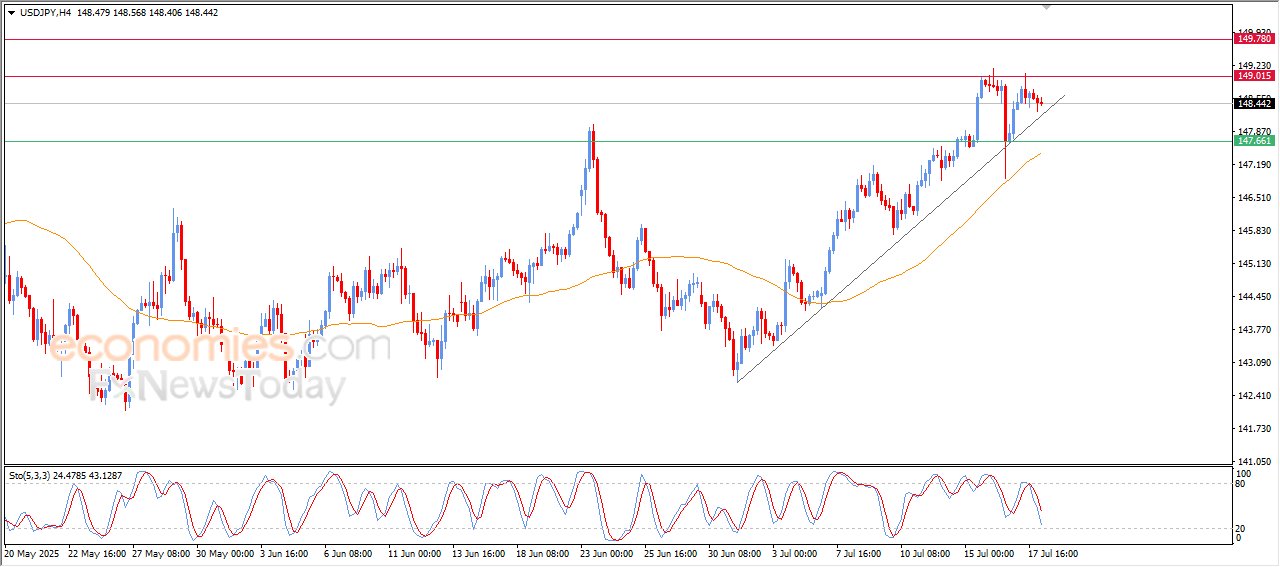

The USDJPY attempts to gain positive momentum-Analysis-18-07-2025

AI Summary

- USDJPY price declined due to resistance at 149.00 and negative RSI signs

- Bullish momentum expected to help breach resistance and target 149.80

- Trading range forecasted between 147.90 support and 149.20 resistance, with a bullish outlook for the day

The (USDJPY) price declined in its last intraday trading, due to the stability of the stubborn key resistance at 149.00, with the emergence of the negative signs on the (RSI), after reaching overbought levels, the price is attempting to gain a bullish momentum that might assist it to recover and breach this resistance.

This comes amid the dominance of the main bullish trend and its trading alongside a minor bias line on the short-term basis, with the continuation of the positive pressure that comes from its trading above EMA50.

Therefore, our expectations suggest a rise in the (USDJPY) prices in the upcoming intraday trading, conditioned by its breaching the resistance at 149.00 initially, to target the initial resistance levels at 149.80.

The expected trading range is between 147.90 support and 149.20 resistance.

Today’s forecast: Bullish

The GBPUSD is rising alongside bearish correctional trend line -Analysis-18-07-2025

The (GBPUSD) price extended its cautious gains in its last trading, attempting to recover some of its previous losses, this rise comes amid the continuation of the bearish correctional trend on the short-term basis, and its trading alongside a bearish bias line, indicating the continuation of the negative technical pressures on the price move.

On the other hand, the pair remains trading below EMA50, reinforcing the negative overview, especially with the (RSI) reach to exaggerate overbought levels compared to the price current move, this sign indicates the possibility of forming negative divergence, which might intensify the possibilities of a downside rebound in its upcoming trading.

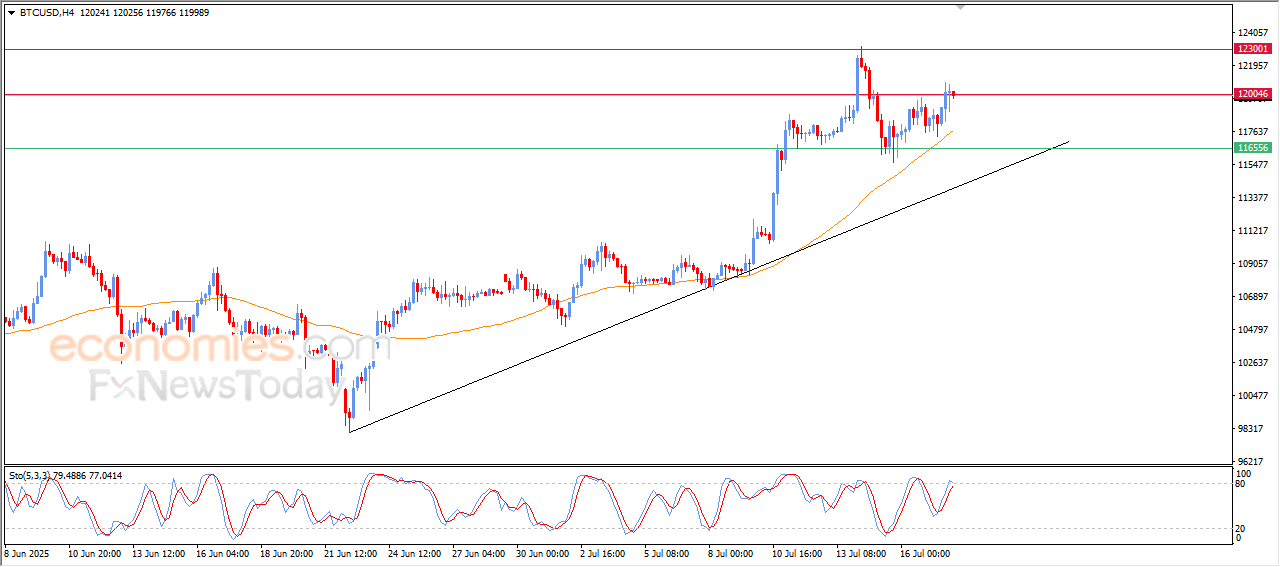

Bitcoin (BTCUSD) is attempting to breach the current resistance -Analysis-18-07-2025

The price of Bitcoin (BTCUSD) settled high in its last intraday trading, attempting to breach the strong resistance at $120,000, supported by its stability above EMA50, reinforcing the bullish momentum currently, this comes amid the continuation of the main bullish trend on the short-term basis, and the trading alongside a supportive bias line.

On the other hand, we notice the emergence of the positive signals on the (RSI), despite reaching overbought levels that might indicate the possibility of the momentum weakness, if the rise continues without a correction, this condition might lead to sideways range moves or a temporary decline unless confirming breaching the current resistance level.

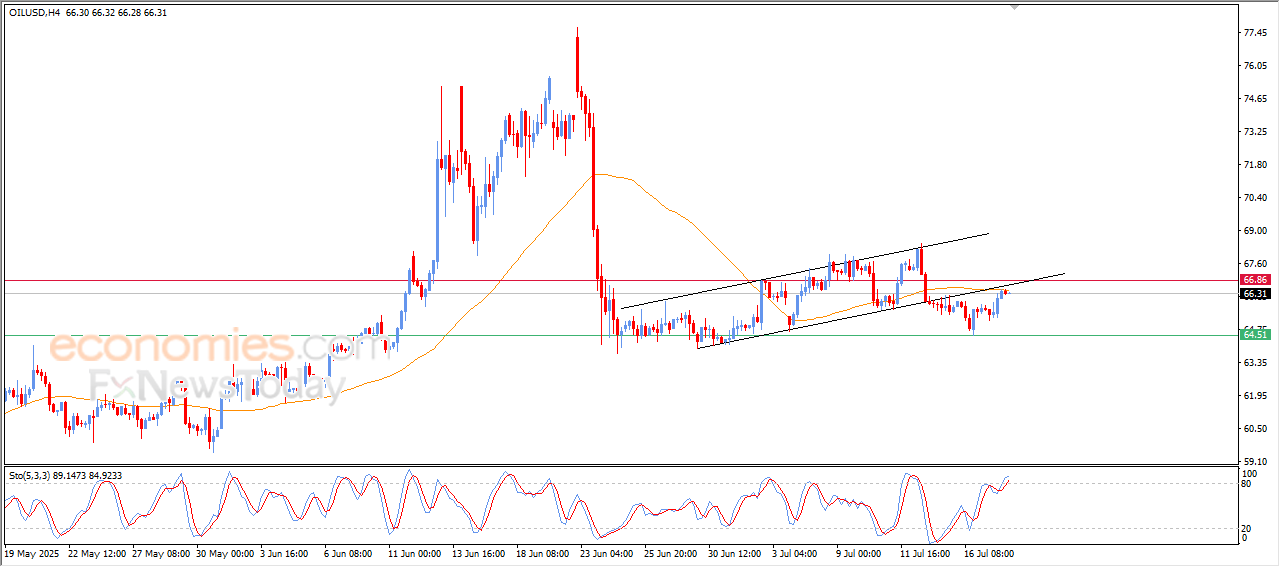

Crude oil prices settle in a strong resistance area -Analysis-18-07-2025

The (crude oil) settled with strong gains in its last intraday trading, supported by the attempt of recovering previous losses, where the price retested minor bullish channel’s support that confined the price in its previous trading on the short-term basis, accompanied by reaching the EMA50’s resistance, which adds technical pressure that might limit the continuation of this rise.

At the same time, we notice the (RSI) reach oversold levels, indicating the possibility of forming negative divergence, this signal may indicate the weakness of the positive momentum, and suggest potential return to the selling pressure unless confirming breaching the mentioned resistance.