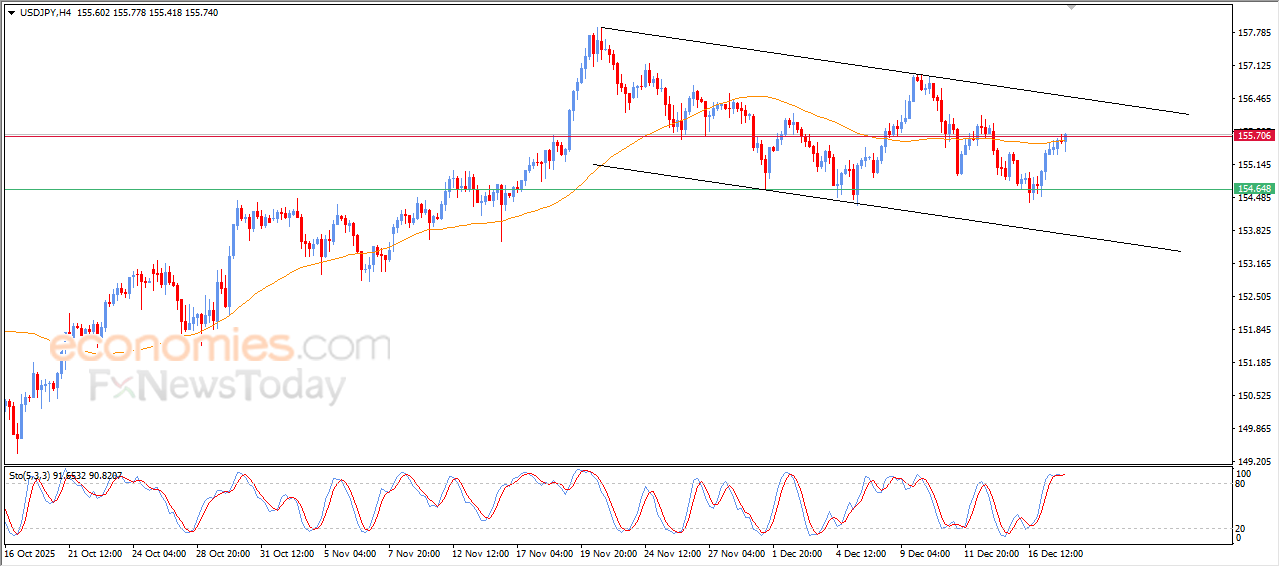

The USDJPY hits the resistance of its simple moving avergae-Analysis-18-12-2025

The (USDJPY) rose in its last intraday trading, reaching the resistance of EMA50, amid the dominance of the bearish corrective trend on the short-term basis and the trading within channel’s range that limited its previous trading, after reaching exaggerated overbought levels compared to the price move, with the emergence of negative overlapping signals, intensifying the negative pressure on the near-term basis.

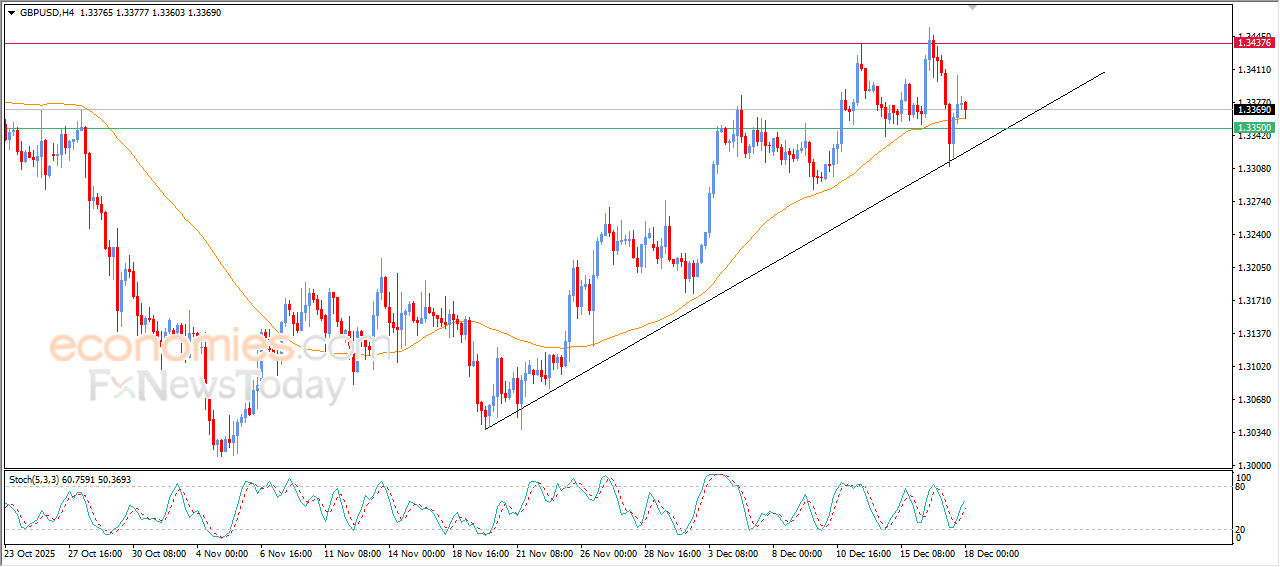

GBPUSD price is leaning on its EMA50’s support- Analysis- 18-12-2025

GBPUSD declined slightly in its last intraday trading, to gather its bullish momentum to help it rise again, leaning on EMA50’s support, amid the dominance of main bullish trend on the short-term basis and its trading alongside supportive trend line for this track, besides the emergence of positive signals on the relative strength indicators, after reaching oversold levels, providing renewed bullish momentum to the pair in the upcoming period.

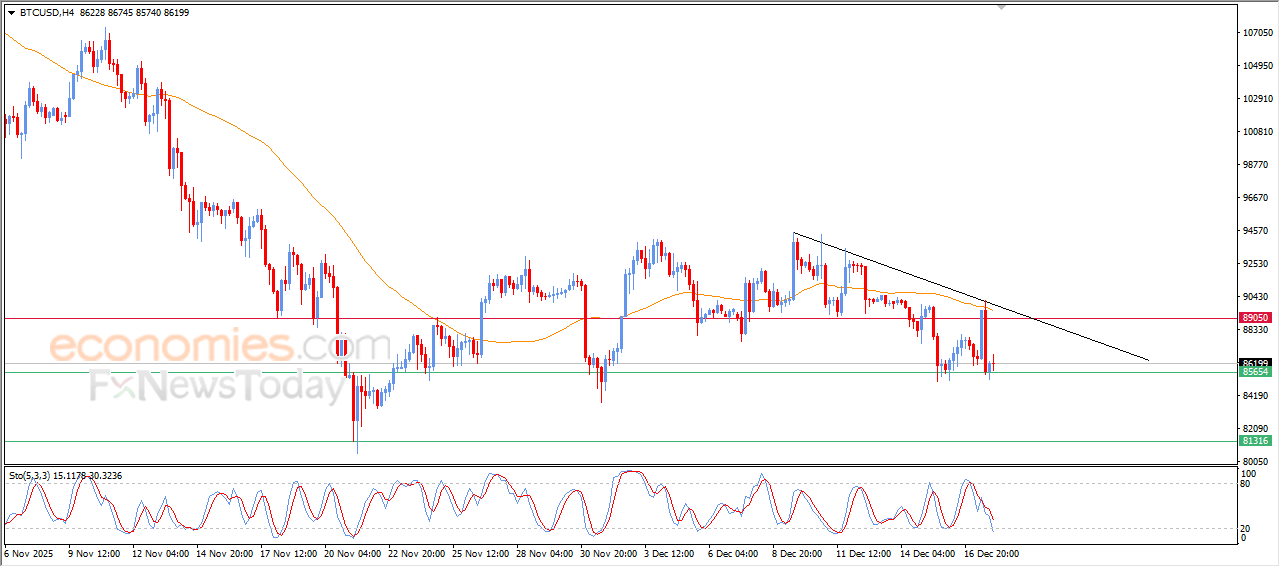

(BTCUSD) is getting ready to break key support- Analysis-18-12-2025

Bitcoin’s price settled with sharp losses in its last intraday trading, preparing to break the key support at $85,500, amid its trading alongside minor bearish trend line on the short-term basis, indicating the continuation of the selling pressures dominance on the trading.

This pressure increases with the continuation of the trading below EMA50, which represents dynamic resistance that limit the recovery chances on the near-term basis, accompanied by emergence of negative signals from relative strength indicators, despite reaching oversold levels, indicating the weakness of the bullish momentum and the price ability to rebound currently.

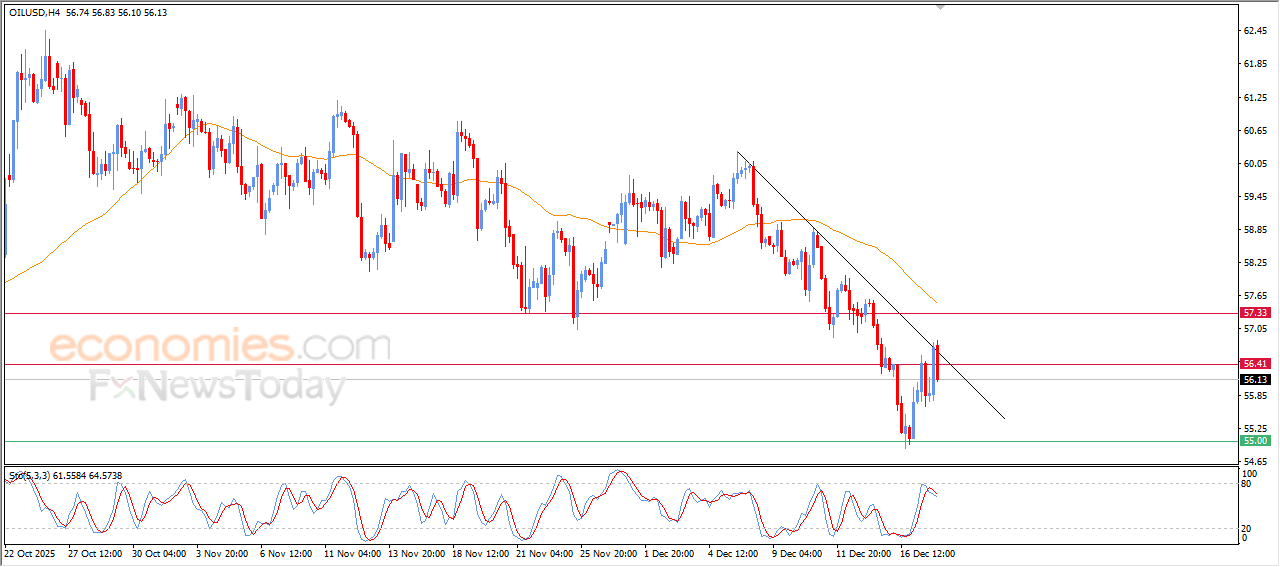

Crude oil price declines, affected by its current resistance- Analysis-18-12-2025

Crude oil declined in its recent intraday trading, affected by the stability of the current resistance at $56.40 after reaching it, accompanied by testing the resistance of steep minor bearish trend on the short-term basis, which intensified the strength of the selling pressure and lost its bullish momentum.

This negative pressure reinforces by the continuation of the trading below EMA50, besides forming negative divergence on the relative strength indicators, after reaching exaggerated overbought levels compared to the price move, with the emergence of new negative signals that might limit any recovery attempts on a near-term basis.