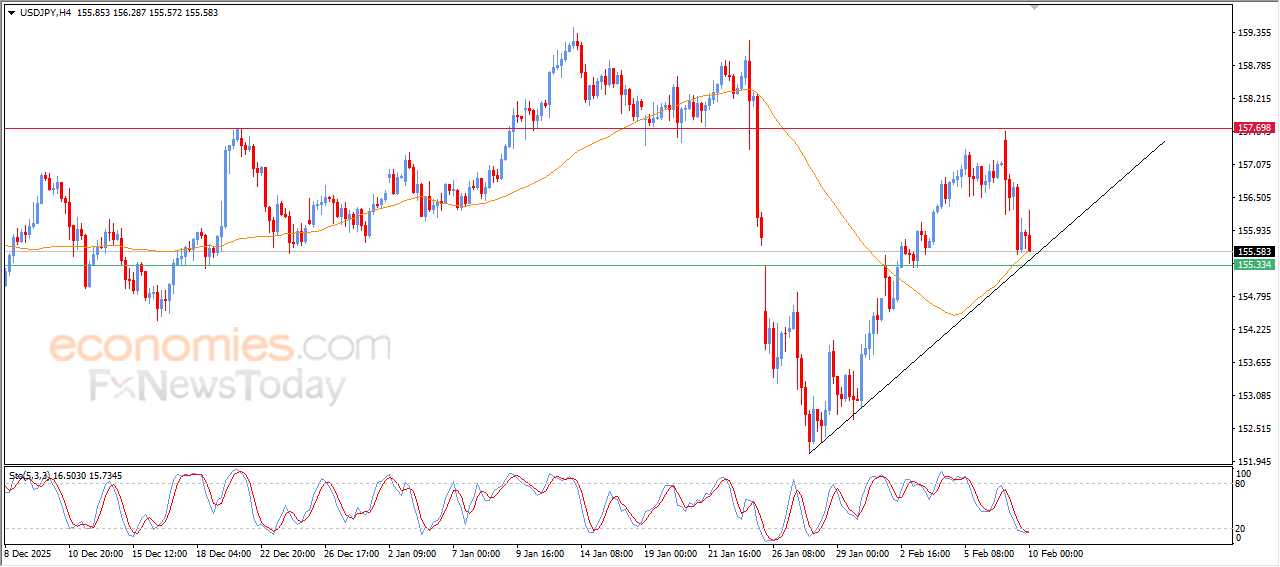

The USDJPY is exhausting its bullish opportunities-Analysis-10-02-2026

The (USDJPY) couldn’t keep its early gains on its last intraday levels, to bounce lower leaning on EMA50’s support, attempting to look for higher low to take it as a base that might help it gain the required momentum for its recovery, especially with its trading alongside bullish corrective trendline on short-term basis, with the relative strength indicators reaching oversold levels, and the emergence of positive overlapping signals from there, which might turn the bullish momentum back to reverse this negative track in the upcoming period.

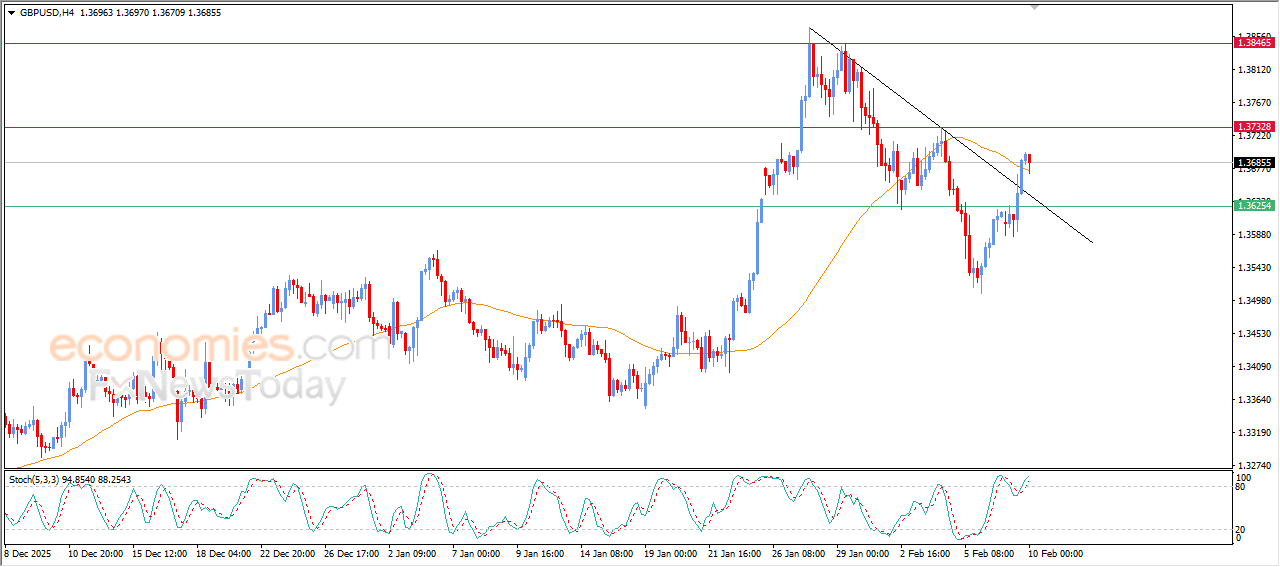

GBPUSD price is breaching bearish corrective trend line- Analysis- 10-02-2026

GBPUSD declined in its last intraday trading, to gather the gains of its previous rises, attempting to gain bullish momentum that might help it to resume its strong gains, affected by breaching bearish corrective trend line on short-term basis, taking advantage of the dynamic support due to its trading above EMA50, besides the emergence of positive signals from relative strength indicators, despite reaching overbought levels.

Bitcoin (BTCUSD) is moving in sideways range below key resistance- Analysis-10-02-2026

Bitcoin’s price settles on limited gains in its last intraday trading, amid sideways fluctuating trading below $71,500 key resistance, and the negative pressure remains valid with its trading below EMA50, reinforcing the dominance of the main bearish trend on short-term basis.

On the other hand, there are some positive attempts with the emergence of supportive signals from relative strength indicators after reaching sharp oversold levels, providing momentum that helped it to settle and attempting to offload this oversold condition.

Therefore, we suggest a decline in BTCUSD in its upcoming intraday trading, if the resistance settles at $71,500 to target the initial support levels at $67,000.

Expected trading range is bewteen$67,000 support and $75,000 resistance.

Today’s forecast: Bearish

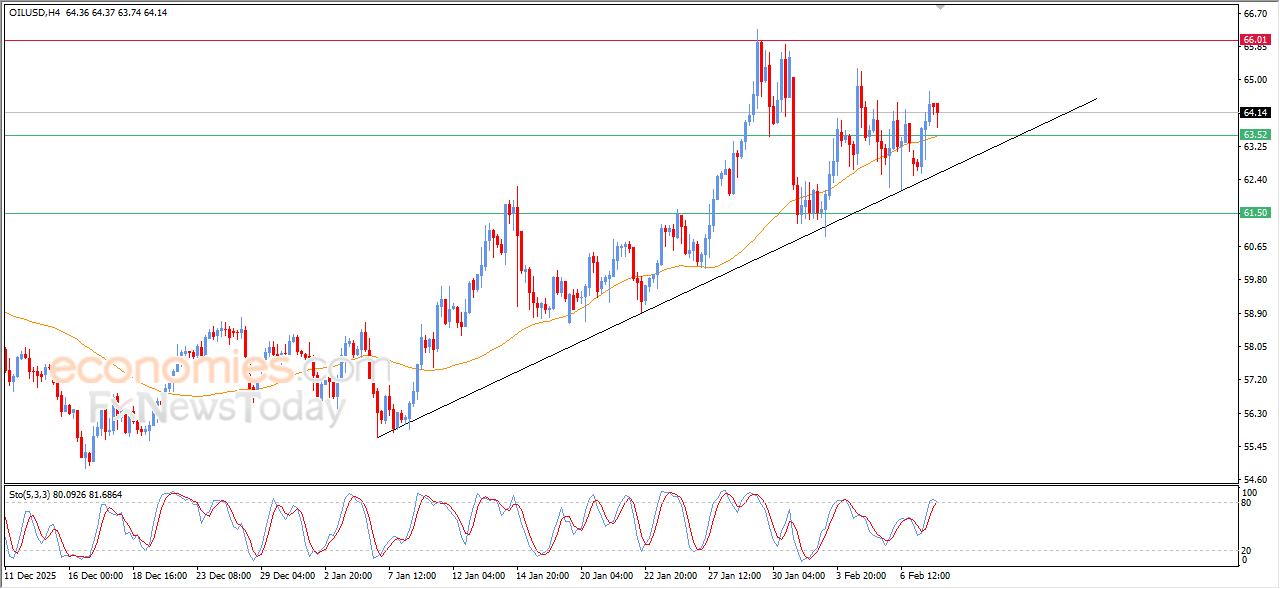

Crude oil prices are gathering bullish momentum- Analysis-10-02-2026

Crude oil prices declined in their last intraday trading, to gather the gains of its previous rises and take breather and gain a new momentum that might support the chances of a recovery and resuming the upside track.

At the same time, the price is offloading its overbought conditions on relative strength indicators, especially with the emergence of negative overlapping signals from there, but the overall scenario remains bullish, with the continuation of its trading above EMA50, which forms significant dynamic support, reinforcing the main bullish trend on short-term basis, with its trading alongside supportive trend line for this path.

Therefore, we expect crude oil to rise in upcoming intraday trading, especially if it settles above $63.50, to target $66.00 key resistance.

The expected trading range for today is between $63.00 support and $66.00 resistance.

Today’s forecast: Bullish