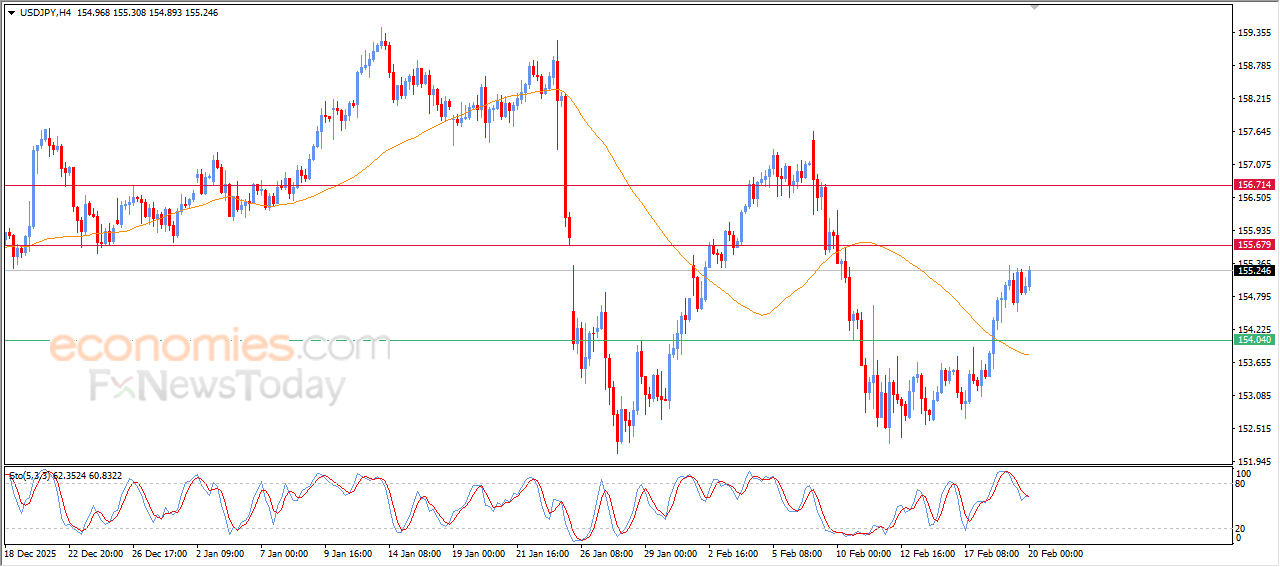

The USDJPY shows more positive signs-Analysis-20-02-2026

The (USDJPY) rose in its last intraday trading, amid the dominance of bullish corrective wave on short-term basis, supported by its continued trading above EMA50, representing dynamic support that reinforces the stability of the gains, especially with the emergence of positive overlapping signals from relative strength indicators, after offloading its overbought conditions, opening the way for extending its gains in the upcoming period.

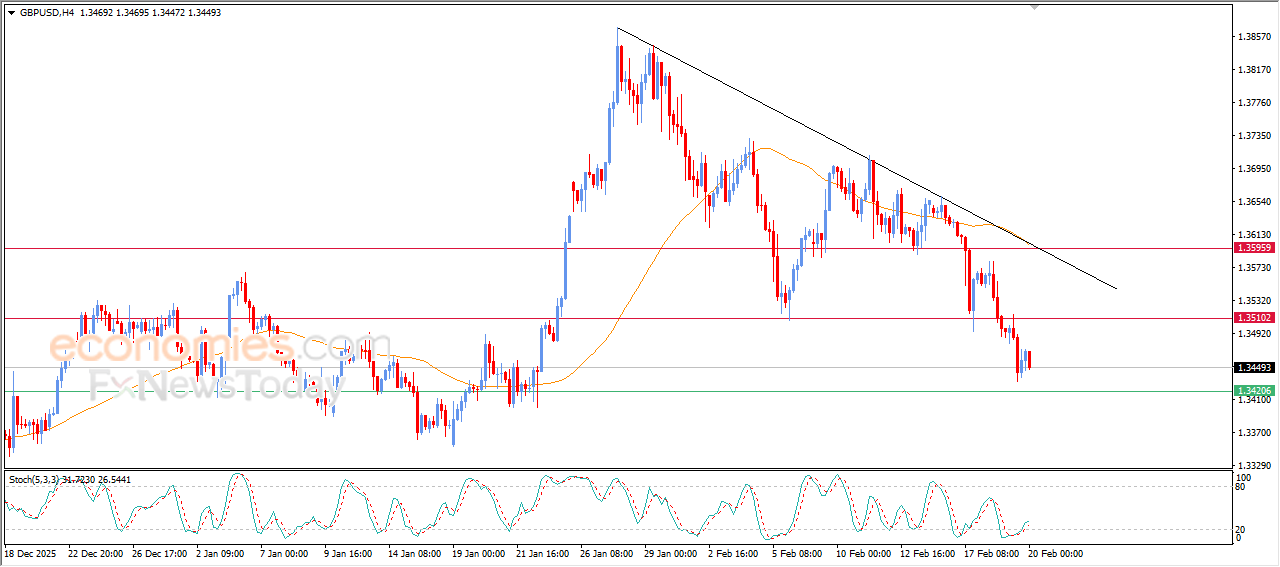

GBPUSD price returns to decline - Analysis- 20-02-2026

GBPUSD returned to decline in its last intraday trading, after offloading its oversold conditions on relative strength indicators, to notice the emergence of negative overlapping signals, intensifying the negative pressure on the price, especially with the continuation of its trading below EMA50, with the dominance of the bearish corrective trend on short-term basis, and its trading alongside supportive trend line for this path.

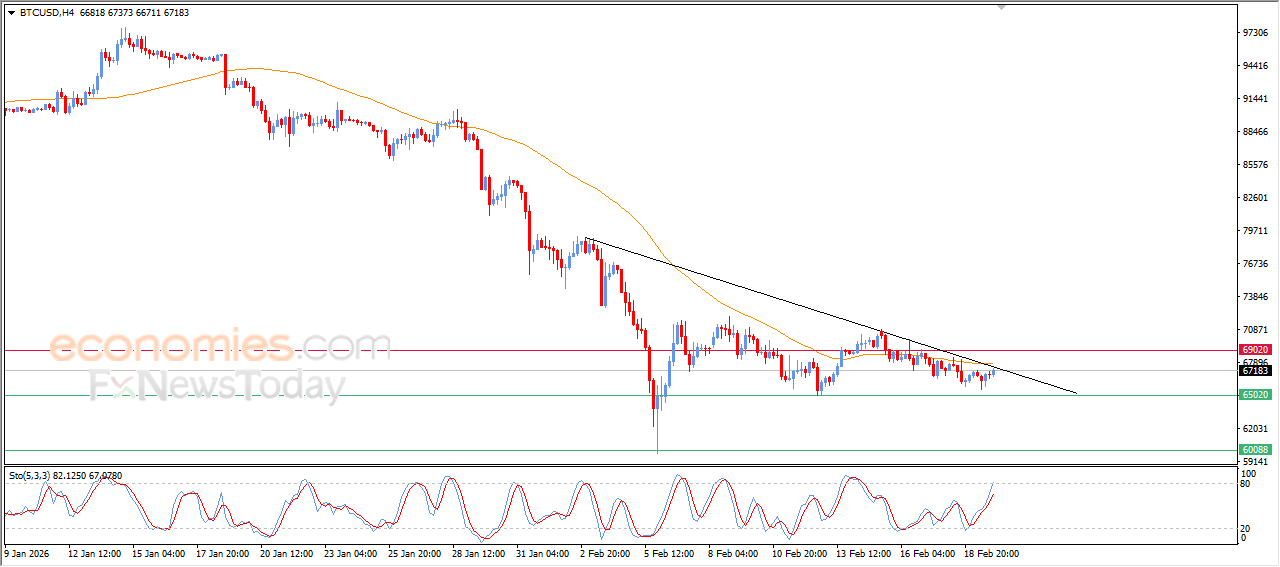

Bitcoin (BTCUSD) surged alongside minor bearish trend line - Analysis-20-02-2026

Bitcoin’s price (BTCUSD) rose in its recent intraday trading, supported by the emerging of positive signals from relative strength indicators, in attempt to catch its breath after the selling pressures, However, the entry of these indicators into exaggerated overbought territory relative to price movement raises questions about the sustainability of this improvement, suggesting that the positive momentum may fade quickly unless stronger buying flows emerge.

This movement is accompanied by reaching the EMA50’s resistance, besides testing minor bearish trend line on short-term basis, to face double technical barrier that increases the strength of the negative pressures.

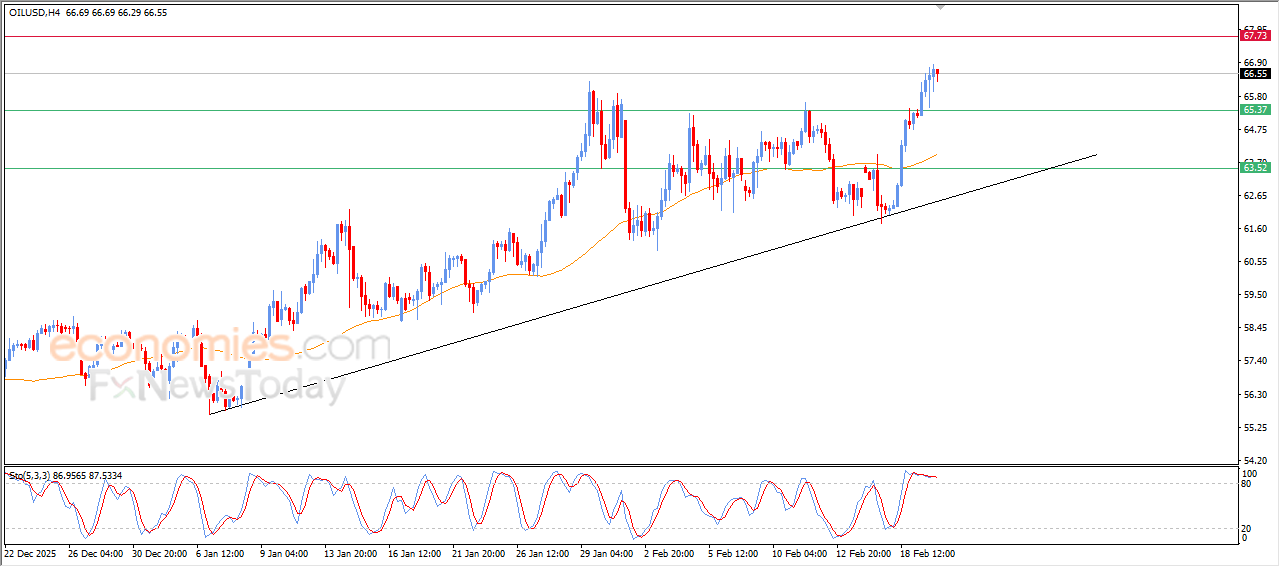

Crude oil prices are taking a breather- Analysis- 20-02-2026

Crude oil prices declined slightly during its last intraday trading, in natural profit-taking followed the previous rise, where the price appears to be regrouping and rebuilding bullish momentum that could support the resumption of the bullish trend. This limited decline represents healthy corrective move rather than structural weakness in the trend, serving instead as a temporary cooling of momentum.

At the same time, the price is attempting to offload some of the overbought conditions on relative strength indicators, especially with the emergence of negative signals from there, however the continuation of the trading above EMA50 provides key dynamic support to reinforce the main bullish trend on short-term basis.