Walmart price readies to tackle pivotal resistance - Forecast today - 01-08-2025

AI Summary

- Walmart Inc (WMT) stock is approaching a pivotal resistance level at $100.00

- A bearish crossover in the Stochastic indicator may limit the stock's near-term upward potential

- Forecast for Walmart stock is bullish, with potential to rise if it breaks above $100.00 and targets $105.00 resistance level

Walmart Inc (WMT) stock advanced slightly in its recent intraday trading, supported by continued movement above the 50-day simple moving average and under the control of a dominant upward trend, trading along a short-term ascending trendline that reinforces this direction. With this rise, the stock is preparing to challenge the key resistance level at $100.00. However, a bearish crossover is beginning to appear in the Stochastic after reaching extremely overbought territory, which could weigh on the stock’s near-term upward potential.

Therefore, we expect the stock to rise in upcoming sessions, but on the condition that it first breaks above the $100.00 resistance level, targeting the next key resistance at $105.00.

Today’s price forecast: Bullish.

JPMorgan price tries to vent off overbought saturation - Forecast today - 01-08-2025

JP Morgan Chase & Co (JPM) stock edged slightly lower in its recent intraday trading, following a hold at the psychological resistance level of $300. The stock is attempting to build positive momentum that could help it break through this resistance, while also working to relieve its clearly overbought Stochastic conditions, especially as early bearish signals begin to emerge. The stock remains under the control of a dominant upward trend, trading along a short-term ascending trendline that supports this direction.

Therefore, we expect the stock to rise in upcoming sessions, provided it first breaks above the $300.00 resistance level, targeting the next resistance at $315.00.

Today’s price forecast: Bullish.

Visa price exposed to increasing negative pressure - Forecast today - 01-08-2025

Visa Inc (V) stock declined in its recent intraday trading, amid bearish signals emerging from the Stochastic after reaching extremely overbought territory. This decline led to a break below a short-term ascending trendline, while the stock continues to face compounded negative pressure from trading below the 50-day simple moving average, further reinforcing the bearish outlook.

Therefore, we expect the stock to decline in upcoming sessions, as long as resistance at $359.65 holds, targeting the key support level at $334.95.

Today’s price forecast: Bearish.

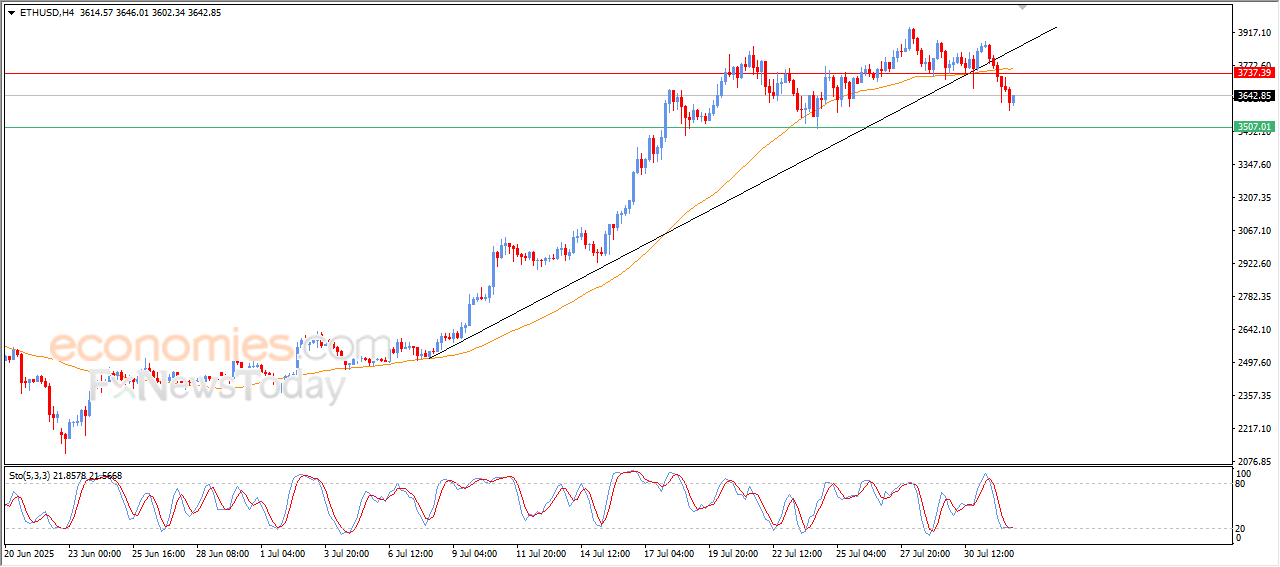

Forecast update for Ethereum -01-08-2025

The price of (ETHUSD) rose in its last intraday trading, attempting to recover some of the previous losses, attempting to offload some of its clear oversold conditions on the (RSI), especially with the emergence of negative overlapping signals, amid the dominance of bearish correctional wave on the short-term basis, and its affection by breaking bullish trend with the continuation of the negative pressure that comes from its EMA50, which prevents any chance for the recovery on the near term basis.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Signals Performance – Week of July 21–25, 2025